Woocommerce: The Most Used WordPress Online Shop Platform for Online Sales

Woocommerce is a perfect solution for those of you who want to create an online store but don’t know how to start. Woocommerce has proven to help thousands of business owners manage their online stores. In fact, Woocommerce is considered the most superior service among other website shop builders.

Woocommerce is also relatively simpler than Magento and VirtueMart. You must be wondering how Woocommerce can be so easy to apply for an online store? Before answering all of that, it is better for us to first understand the ins and outs of Woocommerce.

What is Woocommerce?

WooCommerce is a free eCommerce software that makes it easy for you to sell products and services online. Over the years, Woocommerce has become the world’s most popular eCommerce platform used by millions of small and large entrepreneurs (online stores). WooCommerce is developed as a WordPress extension which is the most popular website builder in the market today.

This plugin allows users to build an eCommerce website from scratch or add shopping cart functionality to an existing website. As open source software, you can download and use WooCommerce for free. However, you still need a domain name and hosting service to make the web accessible to others. Of course, all of this costs you money.

With over 27 million downloads to date, WooCommerce supports 99% of all WordPress stores. It is quite user-friendly so it is very easy to use for beginners. WooCommerce also offers unlimited customization because it is open source.

Historically, WooCommerce was developed by Mike Jolley and James Koster in 2011. They released WooCommerce after working on a replica of the Jigoshop e-commerce plugin. In 2015, WooCommerce and the WooThemes plugin were acquired by Automattic, which is the parent company of WordPress.

The merging of WordPress and WooCommerce further fuels the growth of WooCommerce. Automattic continues to be an active developer for WooCommerce and takes the plugin to new heights.

Using Woocommerce

When using Woocommerce, you need to set up a WordPress hosting account, a domain name, and an SSL certificate. A WordPress hosting account is used for storing all the files on a WordPress site. While the domain name serves as the address of your website on the internet. SSL certificates are needed in order to securely accept online payments.

Even though Woocommerce is free, the three items above (hosting, domain and SSL) cost money. The overall cost of your online store (WooCommerce prices) will depend on the services you choose and purchase for your website. You can easily control spending by only buying what you really need.

When choosing a domain name, use the brand name or keywords of the product you are selling. Avoid using numbers and hyphens when choosing a domain name to make it easier to spell. Then, follow these steps to integrate Woocommerce with your site:

- Choose hosting

- Install WordPress

- Woocommerce activation

- Choose a theme

- Add extension

WooCommerce can be installed as a plugin on any WordPress installation. Woocommerce has also partnered with several hosting companies that offer WordPress installation and e-commerce-specific features, such as special IPs and SSL certificates to keep your store protected and secure.

You have to install wordpress first to use Woocommerce. Many hosting companies provide one-click WordPress installation for users’ convenience. You can choose this option to make the process easier. Otherwise, you can download from WordPress.org and then install by following the given instructions.

You can activate Woocommerce when the WordPress installation process is running. Woocommerce activation can be done by creating a free account at Woocommerce.com, installing Woocommerce by downloading the plugin, or searching for the WooCommerce plugin from within your website.

In the setup wizard, you will be asked to choose a theme. The chosen theme will determine the initial appearance and layout of your online store / site. You can use the free themes included with WordPress or purchase a premium theme.

Expand your store by adding functionality with extensions such as subscriptions, orders, memberships, payment gateways, shipping, and more. You can start your online store/website for free and increase it as your customer base and revenue grows.

Woocommerce Advantage

There are many plugins for e-commerce that you can choose. However, only Woocommerce offers the following advantages:

- Useful for all kinds of products

- Complete and professional features

- catalog

- payment gateway

- courier choice

- discount

- management orders

- shopping cart

- sales report.

- Mobile friendly

- Good security

- User-friendly

- Store performance can be tracked

Woocommerce can facilitate various types of products, ranging from physical products to services or digital products. Later, the system will ask you what type of business and type of product you sell when installing this plugin. After that Woocommerce will adjust the settings according to the product and business field you are in.

The complete features of Woocommerce will make it easier for you to create an online website without having to have an understanding of coding. So, you no longer need to create a website from scratch because this plugin provides various features such as:

Woocommerce site design is also mobile friendly. So, users can access it via cell phone or smartphone without reducing user experience. For those of you who want to do your business online, having a mobile friendly website is mandatory because nowadays more people access websites on their cell phone.

This plugin regularly updates and releases more secure protection so you don’t have to worry about customer data leak. The security process is also carried out through its own database so that data leakage can be minimized with layered protection.

Woocommerce is specially designed for WordPress so it can be directly applied to the website, so does the design of the theme. WordPress also has a lot of users so almost everyone is familiar with this website. Therefore, you can easily find solutions when there are errors or other security problems.

Not only selling, you can also develop your business through Woocommerce. This is because this plugin also provides analytical features that help you oversee your store performance. This analytical feature can be used to analyze the number of items sold, turnover, promotions, and much more. You can use all of this data later as a material for evaluating your store performance.

Besides setting up an online store website to accommodate all information about your business, you also need one more feature to make it easier for your customers to pay online. Connect your online store website with a payment gateway like Duitku. Duitku provides WooCommerce Plugins with your website.

Duitku as a payment gateway in Indonesia has tested security features that will protect all transactions on your WooCommerce website. Come join DUITKU, and get a brand new experience with us!

Get to Know about Ecommerce Enabler and Its Advantages for Business Owners

The way people shop has significantly changed in recent years. They used to shop directly at the store, now they shop more on online stores or e-commerce. The development of technology has surely contributed to the growing e-commerce market.

This makes online shopping activities feel more satisfying for customers. Therefore, businesses that focus on e-commerce-based sales are now attracting many entrepreneurs.

So, are you one of those who want to start implementing an e-commerce-based sales focus on the business you are currently in? To focus on e-commerce-based sales, you need to be familiar with the term e-commerce enabler and its benefits for entrepreneurs.

What are e-commerce enablers?

An e-commerce enabler is a company that provides end-to-end solutions for brands doing e-commerce business. These services include authorized store management, digital marketing, creative services, customer service management, supply chain management and fulfillment. In other words, e-commerce enablers help brands to succeed in their online sales through e-commerce platforms and other online channels. Digital strategy and execution, platform optimization, order processing and fulfillment, as well as product delivery through 3PL partners are common things needed for an enabler

E-commerce enabler offers one-stop solutions such as website optimization, creating market strategies, integrating all digital media, supervising customer service, handling shipping and logistics, so that you as a client can fully focus on the growth aspect of the business.

It can be said that the business model carried out by this e-commerce enabler company is BRB or business to business. There are also various services provided by e-commerce enablers, ranging from content production, marketing, channel integration, to product delivery to customers.

How Do E-commerce Enablers Work?

E-commerce enabler works with three models, namely general operations, distribution models, and content services. Here’s an explanation of each:

- General operation

- Distribution

- Content service

This model focuses on the branding side of an online store by taking the name of the operating service provider. Process services are also fully provided for e-commerce based sales. Marketing and promotion costs are charged to the brand. Later, the income can be in the form of fees and commissions on sales that occur.

In this model, the service provider makes a complete purchase of a product from a brand using their own funds. After that, they set up shop on the e-commerce platform to resell the product.

After the goods are sent to the service provider, the sales process has been completed and the marketing costs are fully borne by the service provider. The responsibility for selling the product also shifts to the service provider. However, service providers can collaborate with brands to conduct sales campaigns.

If you use this model, the service provider only offers product marketing or e-commerce planning solutions for your brand or provides content for product promotion. Service providers also charge fees related to the marketing services they provide.

E-commerce Enabler Companies in Indonesia

The success of e-commerce cannot be separated from the role of e-commerce enablers. There are several e-commerce enablers that are widely used by local companies. The following is an example of an e-commerce enabler in Indonesia:

- aCommerce

- Jet Commerce

- Sirclo

- SCI E-Commerce

- Berdu

aCommerce is an e-commerce enabler founded in 2013 and headquartered in Bangkok. This e-commerce enabler has been operating in several Asian countries such as Indonesia, the Philippines, Malaysia, and Singapore.

Jet Commerce is an official partner of Alibaba which was founded in 2017. Over time, Jet Commerce has penetrated into the e-commerce industry where brands can sell online. Apart from Indonesia, Jet Commerce also operates in China, the Philippines, Vietnam and Thailand.

Sirclo has served various marketplaces such as Tokopedia, Shopee, Lazada, Bukalapak, and Blibli.com. The company handles end-to-end sales through the marketplace, from managing stock of goods to product delivery. Sirclo itself has managed more than 200 brands.

SCRI E-commerce is an e-commerce enabler originating from a neighboring country, Singapore, and has been established since 2017. Since operating in Indonesia, this e-commerce enabler has partnered with several marketplaces such as Bukalapak, Tokopedia, and JD.id.

Next is Berdu, which was founded in 2015. Berdu is an online store website maker platform with a simple but sophisticated display. Equipped with a myriad of features from order management, CRM, to team management. Berdu can be accessed properly using a smartphone so that it is easy to control anytime and anywhere.

The Advantages of E-Commerce Enabler For Entrepreneurs

For entrepreneurs, e-commerce enablers have the following benefits:

- Get an excellent service by experienced brand consultants

- Store Operations.

- Digital Marketing

- Content Localization

E-commerce enablers have the experience and expertise in running an online store so they know exactly how the industry works. They have data that can be used to develop an online store. With this data, e-commerce enablers can ensure effective growth for their clients.

The e-commerce enabler also helps you to prepare all the aspects needed for effective and efficient store operations. From launching stores, managing product lists, to WCRA (War Commander Rogue Assault Indonesia) handling consumer complaints, e-commerce enablers can help you. You need an experienced team to do this so you can focus on other aspects of your business like product development.

Digital marketing is an important key in running an online business. In doing digital marketing, you need copywriting skills, social media, and various other campaigns. If you feel you don’t have these skills, an e-commerce enabler can help with your shortcomings. Enable e-commerce usually has a digital marketing team that is expert for all things needed in that field.

If you want to expand your business to other countries, take advantage of enabling e-commerce to create content that is familiar in your target country. Content localization includes not only language, but also format and design, as well as cultural sensitivities. For example, if you are an Asian brand owner looking to enter the European market, your brand content needs to adapt to their local language, cultural sensibilities, way of life and preferences. This way, your product will be better received in the region.

For those of you who have an online business of your own brand, you can look at the e-commerce enablers. Moreover, with the advantages of e-commerce enablers who are very helpful for entrepreneurs, using them will surely be very profitable. Start building your own brand and join an e-commerce enabler.

Don’t forget to integrate your website or online business app with a payment gateway. By using a payment gateway system like Duitku, your business will be able to accept various payment options that are done automatically 24/7. Duitku as an Indonesian payment gateway that has obtained permission from Bank Indonesia and has a standard payment card industry data security certificate (PCI-DSS) will give your customers a sense of security when transacting.

Let’s integrate your business with Duitku and increase customer satisfaction and loyalty! Let DUITKU take care of your transaction!

Get to know WHMCS and its Use

WHMCS is a practical solution for those of you who want to start a web hosting business or offer web services. With WHMCS, you will no longer have to worry about how to activate products, create financial reports, or make billing to clients. For web designers and developers, WHMCS can be a way to combine additional services with clients and maintain an ongoing relationship after development is complete.

Client management panels such as WHMCS can be used to automate the creation and management of client web hosting services. The use of WHMCS cannot be separated from web hosting. Web hosting makes the files that comprise the website (code, images, and the like) viewable online. Every website you’ve ever visited is hosted on a server.

Managing a server certainly requires a stable and strong network because the web hosting will be connected by many networks. WHMCS is what functions to manage sites and accounts on the server. So, WHMCS can be used to manage all the things that server users need, such as payments, registration, and various other services provided.

What is WHMCS?

WHMCS stands for Complete Web Host Manager Solution. Initially, HMC was developed as a control panel that allows automatic provisioning of cPanel web hosting accounts using the Web Host Manager control panel. WHMCS is a web-based web host manager application which was first developed by Matther Pugh in 2003. Initially, this web host was developed to simplify and automate whatever is required for web hosting companies.

This software tool functions as a consumer manager as well as payment and billing. The app also helps provide consumer support for other online based businesses. It can be said that WHMCS can be relied on to overcome all things related to web hosting. Using this tool, hosting providers can save hours of time as they can automate repetitive tasks, which in turn allows you to focus solely on growing your business.

This step provides an easily accessible management interface that provides and manages things like customer registration, service/server provisioning, management and support. WHMCS is perfect for retailers, agencies, and developers looking to streamline or expand their web-dependent businesses.

WHMCS is a full-featured web hosting client management panel. Its main goal is to provide web hosting businesses with a system that can be integrated into websites so that visitors can purchase web hosting services. WHMCS integrates with various web hosting servers and related apps so that when a client purchases a service on your site, WHMCS will collect the payment, creating a user account for the client to manage their service. Automatically, WHMCS also provides a web hosting account on the hosting server. This process can save time and make work simpler.

Initially, WHMCS was an independent company. Then in 2012, the company partnered with cPanel. With this partnership, WHMCS can provide integration with cPanel so as to provide greater benefits for its users.

Uses of WHMCS

WHMCS contains all the necessary tools to make the work of a web hosting business easier. Therefore, this device has several functions such as the following:

- Customer support

- Billing management

- Report

- Fraud Management

- Order management

- Domain registration

WHMCS is not only used to manage cPanel accounts. This tool can also be used to automate provisioning on:

- VPN Account

- Game Servers

- VPS Hosting

- Domain

- Email Account

- And a wide range of other web service related products.

How to Use WHMCS

To use WHMCS, there are several steps you can do. Here’s how to use WHMCS:

- Buy a license

- Buy a server and install

- Device configuration

- Device integration

Purchase a license for WHMCS on their website. You can choose a package based on the number of clients you expect and also you can increase it anytime in the future.

Purchase a server and install WHMCS on it using the WHMCS installation wizard. We recommend that the server use cPanel/WHM so that WHMCS can be easily installed. WHMCS is also available using Softaculous if you have one.

Once the WHMCS installation is complete, you can start configuring it with the software. This includes creating products, setting up panel designs on your website, and more.

You can integrate WHMCS into your company’s main website or just use it as a stand-alone interface for users to purchase domains and other hosting services from your company.

As previously mentioned, since 2012 WHMCS has partnered with cPanel so that these devices can integrate with each other. Therefore, the WHMCS installation process can be done easily if you have installed cPanel and Softaculous. If you already have both, you just need to press the click button like a WordPress installation.

Then, if you already have cPanel, here’s how to install it

- Log in to your cPanel account then in the menu section select mysql database wizard. After that, enter the database name and enter the username and password you want.

- After that, select the file manager, then public and HTML. Then do the process of downloading or uploading the web host manager complete solution file.

- Then open the website and a warning screen will appear. Then install Webhost Manager Complete Solution.

- Fill in the name in the database and don’t forget to also fill in the username, password, license key, and email.

- Open cPanel and select file manager. After that, find the installation folder and delete the folder.

This installation process can be done when you already have a valid license key. If you don’t have it, you can install a website and manage a complete solution. You can also get a valid license key by contacting customer support for more information.

Do you know that your online business can also easily connect with WHMCS through Duitku? Duitku as Indonesia’s payment gateway has provided a WHMCS plugin which can be easily integrated with your online business website. Your online business transactions will become easier when you integrate a payment gateway. There is also support from Duitku customer service who is always ready to serve you 24/7.

Let’s make your life easier with DUITKU!

5 Most Exclusive Credit Cards in Indonesia

Credit card holders must be familiar with black card. Recently, the term ‘black card’ has gone viral in several videos uploaded on TikTok. Black card is a type of credit card that is exclusively issued by American Express and is intended only for the super rich in the world.

This type of credit card does not have a limit, so not everyone can have this special card. By having a black card, some people have their own prestige. But make no mistake, all the features it has are worth the annual fee and features it has.

Our country also has several black card credit cards issued by banks in Indonesia. Surely, they come with commensurate terms and conditions of the cardholder. For instance, do you remember the viral news about credit cards with a very high limit of up to billions of rupiah belonging to Pak Ahok? It is not fake news. The credit card owned by Mr. Basuki Tjahaja Purnama is a corporate class. As the President Commissioner of PT Pertamina (Persero) with a salary of around Rp. 170 million per month, of course it is not a joke that his credit card limit is very high, which reaches Rp. 30 billion.

Banks are willing to offer such a high limit on exclusive credit cards for high-class priority customers. Exclusive types of credit cards are also issued by banks operating in Indonesia. The following is a list of the most exclusive credit cards in Indonesia:

- HSBC Visa Signature

- Mandiri Signature

- Citi Prestige Card

- BRI Infinite Card

- MegaFirst Infinite Card

HSBC Visa Signature credit card has a maximum limit of up to IDR 1 billion. Your minimum income or salary has to be IDR 20 million per month to own this type of credit card. To enjoy the facilities offered by HSBC Visa Signature, the user has to pay an annual fee of IDR 1 million. Then for additional cards, you will be charged an annual fee of IDR 500 thousand per card.

This credit card is suitable for those of you who like traveling or just go out of town, because with the HSBC Visa Signature you can get the benefit of free airplane tickets as much as you want. You can redeem mileage at a very competitive rate. You can enjoy flight reservations, hotels and transactions with 4x rewards points, as well as 2x rewards points for overseas transactions.

Bank Mandiri issues several types of credit cards with high limits of up to Rp 1 billion. This includes the Mandiri Signature credit card, which has a limit of IDR 40 million to IDR 1 billion. Your minimum salary or income has to be at least IDR 20 million to apply for this credit card.

The membership fee for the main card is IDR 900 thousand / year and for additional cards it is IDR 450 thousand / year. You will be charged IDR 150 thousand if the usage exceeds the credit limit. If the physical card is lost, you will be charged IDR 50 thousand per card.

The Citi Prestige Card credit card sets a very high initial credit limit of IDR 100,000,000. For those who already have an established income, this credit card is suitable for you since one of the requirements is that your minimum income has to be at least IDR 42,000,000 per month, which means your minimum income is around IDR 500,000,000 per year.

The annual fee for this Citi Prestige Card is IDR 3,500,000 and cannot be waived for any reason. The fee for an additional card is IDR 1,500,000 per year. Surely, the costs incurred are commensurate with the benefits given. The service and convenience given to the Citi Prestige Card holder is also top-notch, number one quality like a VIP (Very Important Person).

You will be given a facility called Citi Prestige Concierge, which functions like having a personal assistant who can manage and take care of all your needs 24 hours non-stop every day, and many other benefits.

Another exclusive credit card is the BRI Infinite Card as a lifestyle card. With the initial limit, starting from IDR 150,000,000 to IDR 999,999,999, which is almost IDR 1 billion. This is intended for BRI priority customers with a minimum AUM of IDR 500,000,000.

One of the requirements to apply for a BRI Infinite Card credit card is to have a minimum income of IDR 20,000,000 per month and are Indonesian citizens. The annual fee is IDR 2,400,000 and the annual fee for additional cards is IDR 1,200,000.

One of some facilities you can enjoy as a BRI Infinite Card holder is a service of premium waiting room facility at the airport so you do not have to queue while waiting for your flight. You can also enjoy the BRING, the benefit where you can shop using installments with small interest and several due date options of up to 36 months. Moreover, the BRI Infinite Card has been equipped with BRI Protection Plus.

The MegaFirst Infinite Card has a minimum limit of IDR 100,000,000. This card is intended for Bank Mega’s priority banking service for MegaFirst customers. MegaFirst Infinite card holders will get the best benefits provided by all companies which have joined the CT Corp and other merchants who collaborates with Bank Mega.

The most interesting thing about this credit card is they do not charge an annual fee, an annual fee for an additional card and an admin fee for late charge, as long as the customer has a MegaFirst membership. To apply for this type of credit card, your income has to be at least IDR 20,000,000 per month.

If you are a MegaFirst Infinite Card holder with an average balance for the last 3 months of IDR 2,000,000,000, you will be given the right to a complimentary Priority Pass card. With this card, you will enjoy free access to VIP Lounges from more than 1,300 major airports in 500 major cities & 120 countries. Wow, this card is really suitable for those of you who like to travel overseas.

Some of the most exclusive credit cards in Indonesia we have discussed before have their own distinct advantages. Get more information for your consideration before choosing the right credit card. The limit provided by an exclusive credit card is surely high, but lest you fall into a prolonged debt. Use a credit card wisely according to your current financial ability.

As a business owner, do you want your online store website to accept payments using credit cards? If you do, you can register for Duitku now! Integration with Duitku will allow your online store website to accept various payment methods. Get started with credit cards, virtual accounts (bank transfers), e-wallets, and many other payment methods very easily. Duitku has also been licensed by Bank Indonesia. So, let Duitku protect your transaction security!

Direct Cash Disbursement via Pos Indonesia Office Network

To run a business effectively, many business owners are automating their remittance process with a disbursement system. The disbursement process is widely used to process payments to business partners, process refunds, or disburse user funds. The disbursement process can speed up the process of distributing funds because the process does not have to be done by an admin and can be done 24/7. The large volume of transactions at the same time is also not a problem.

Disbursement funds are usually sent to the user’s bank account or user’s e-wallet account. Even so, the majority of Indonesian people still feel more comfortable transacting using physical money. In fact, until mid-2021 yesterday, 51% of adults in Indonesia did not have a bank account, although 70% of Indonesians already had internet access.

To answer this problem, Duitku collaborates with PT Pos Indonesia to facilitate merchants to send funds in the form of cash through post office outlets spread throughout Indonesia.

Established in 1746, the Indonesian Post Office aims to ensure the security of sending residents’ letters. Currently, the post office network has reached 24 thousand service points and is spread over almost 100% of every sub-district and 42% of every village in Indonesia. In addition to collaborating with the Indonesian Post Office, you can also disburse funds in the form of cash through Indomaret outlets with Duitku!

There are 2 types of cash disbursement that you can use through Duitku:

- Cash to Account

- Remittance

The amount of funds that can be sent for each disbursement transaction starts from IDR 50,000 to IDR 2,000,000, and the transaction fee for each successful disbursement is IDR 8,000 (including VAT).

The amount of funds that can be sent for each disbursement transaction starts from IDR 10,000 to 15,000,000 IDR, and the transaction fee for each successful disbursement is IDR 25,000 (including VAT).

*Duitku does not charge registration fees or maintenance fees, all fees are based on the number of transactions.

How do I open a cash disbursement channel through Pos Indonesia on Duitku?

Currently, the Pos Indonesia disbursement channel can be used by all Duitku corporate merchants who already have a Disbursement Cooperation agreement. PT Pos Indonesia’s cash disbursement channel is an open API. Merchants can directly integrate the Cash Disbursement API into their website or app. However, for the first activation of this disbursement channel, the merchant must inform the activation request via email to [email protected]. Disbursement API Key will be sent via the registered email.

How do users withdraw cash through Pos Indonesia office?

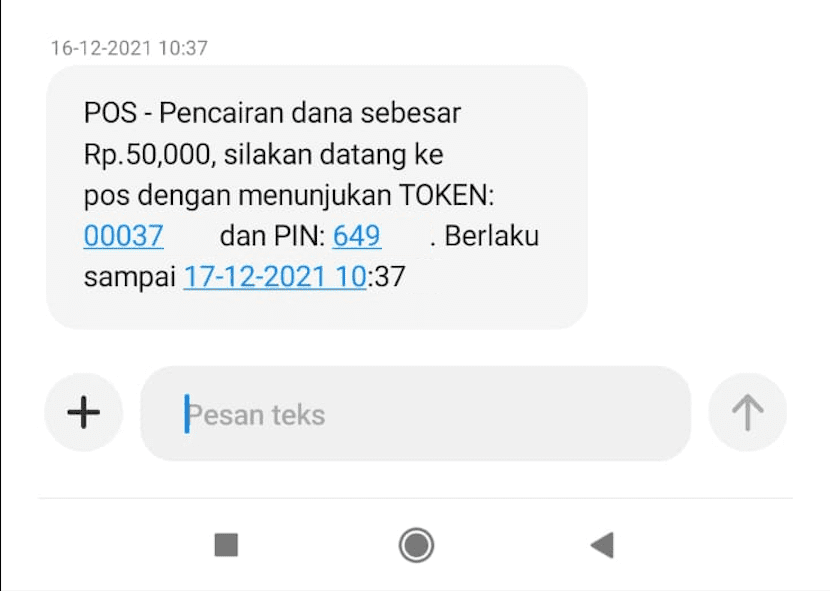

After the User chooses to receive cash funds through Pos Indonesia office, the User will receive an SMS consisting of a unique code to identify the withdrawal of funds along with a PIN number to take the funds.

Example of a cash disbursement code message

After receiving the following message, the User can withdraw funds by:

- Visit the nearest Pos Indonesia counter

- Inform Pos Indonesia officers to process the disbursement of Digital Postal Checks

- Inform Pos Indonesia officers regarding the Clearing/Check number and also the PIN

- Pos Indonesia officers will confirm customer data

- If the funds withdrawn are more than 2 million rupiah (using remittance), Pos Indonesia officers will ask the fund taker to provide 2 photocopies of his ID card and ask for some information to confirm the identity of the funder.

- Pos Indonesia officers submits a certain amount of funds according to the transaction that has been made

- If the transaction is successful, a payment receipt will be printed, as a proof that the money has been received, the customer will be asked to sign the printed receipt.

- Transaction complete.

This easy way to send money via Pos Indonesia is very helpful for financial transactions without a bank account and e-wallet. With this convenience, for online business owners and as a Duitku disbursement merchant, you can send money in the form of cash automatically.

Integrate now and facilitate your Users / Customers, so they will use your platform more often!

Easiness in Accepting Payment via Neo Commerce Bank (BNC) with Duitku

The existence of a digital bank has been facilitating various types of business and provides digital services for various purposes. All types of services, from opening accounts, deposits, transfer and so on can be done online without having to visit the bank.

The digital banking industry in Indonesia is now enlivened with the presence of various new digital banks, one of which is Bank Neo Commerce (BNC).

Neo Commerce Bank is a digital-based bank that makes it easier for users to carry out various banking activities. Previously, Bank Neo Commerce was known as Bank Yudha Bhakti which had more than 30 years of experience in the Indonesian banking industry. Neo Commerce Bank (BNC) has arrived on your cell phone through a mobile app called neobank.

To facilitate customers who want to make payments via bank transfer from a Neo Commerce Bank account, you can connect your website or online app with a payment gateway, one of the payment gateways that have collaborated with Neo Commerce Bank is Duitku. You can first create an account at www.duitku.com to register your website or application to accept payments through BNC or various other banks. Of course, there are also payment options via e-wallet, credit cards, retail outlets, and many others.

How do I open a Neo Commerce Bank payment channel on Duitku?

Currently, payment transfers from Neo Commerce Bank (BNC) are open API and can be used by all registered and active merchants, both individuals and companies. You can activate this type of payment via the Duitku account dashboard page > My Project > Payment Methods.

The type of BNC payment transfer will later be available on the menu display with a service fee of IDR 3,000, – (price includes VAT).

Currently, Duitku is holding a free service fee promo for payments using VA Bank Neo Commerce for the period until March 31, 2022. Let’s don’t miss this opportunity!

Information on service fees from other payment methods can be found here. Duitku never collects registration fees or maintenance fees. All fees listed are based on the amount or nominal of the transaction.

After activating the VA BNC payment channel, do I have to integrate again?

For those of you who have an online store website such as using the Opencart, Prestashop, WHMCS, JoomShopping, Magento, Virtuemart platforms or in WooCommerce (WordPress) you can carry out the integration process by downloading the plugins available directly in the Duitku documentation to find the various payment method options available, one of which is Bank Neo Commerce (BNC).

If previously your online store has been integrated using Duitku plugins, you can simply update the plugins via your platform dashboard with the latest version of plugins to add available payment options.

For merchants who integrate via a custom API, you can integrate payment methods by adding the integration code “NC” or check more information through the Duitku API page.

How to make online transaction bill payments at Neo Commerce Bank (BNC)?

To pay the BNC Virtual Account bill, you can do it through the neobank app or through another bank (an IDR 2,500 interbank transfer fee will apply or at the discretion of the sending bank).

Neobank Mobile Banking

- Open Neobank Mobile App (Android/IPhone Version)

- Select the VA Payment menu

- Select BANK NEO COMMERCE / BNC – 490 as the destination bank name

- Enter the Virtual Account number

- Confirm payment information and enter your PIN

- Transaction completed

ATM or Other Mobile Banking

You can pay VA BNC bills through other apps or ATMs by selecting the “Interbank Transfer” option. When choosing the destination bank, make sure you enter the Bank Neo Commerce/BNC-490 bank code number, followed by the 18-digit BNC virtual account number according to the bill.

Find more information about payment gateways on our website. Register and try Duitku’s free demo! For more information, please contact us directly via email [email protected] or via live chat on the Duitku Dashboard

Let Duitku take care of your transaction!

Get to know 10 Benefits of Activating Online Transaction for Your Business

In the modern era like today, the internet has certainly become one of the needs that really help all human activities. One of them is for making a transaction. Various simplicities are offered by the internet to make payment transactions. There are various benefits of activating online transactions for people’s businesses. You don’t need to go to the bank or payment counters to make transactions because all types of transactions can be done online.

To accept online payment transactions, business owners certainly need to have access to an online payment gateway system, which is an integrated payment service provider that provides various types of payment methods for the buying and selling process of products and services. Therefore, online payment systems are now much favored by business owners because they have many benefits.

Definition of Online Transaction

Online transactions are something that is commonly done by various people in the modern era like today. Especially during a pandemic, the digitization process has developed rapidly, including in the business sector. At a time when people’s mobility is limited, online transactions are the right choice to fulfill our various types of needs.

By using online transactions, primary needs such as buying food, drinks, and fulfilling other household items can be done faster. In addition, tertiary needs such as gadgets, automotive, or other hobbies can now be done easily without having to make conventional payments.

Over time, users of online transactions are increasing. That means, more and more consumers are used to doing online transactions every day. Business owners then make the best of this trend so they won’t be left behind.

Types of Online Transactions

With the rapid development of digitalization, people no longer need to get up from their chairs just to carry out a transaction. Because it can be done by using a smartphone connected to the internet network. The following are the types of transactions most often carried out online by the general public.

- Buying Mobile Balance

- Paying Electricity Bills

- Buying Transportation Tickets

- Paying BPJS Bills

- Paying Phone Bills

The first type of online transaction that is most often carried out by the general public in this modern era is buying mobile balance. In the past, people had to go directly to the nearest mobile balance store, but now this is no longer necessary because we can do it online via mobile banking or using an e-wallet application.

Before online transactions exist, it took some time just to pay electricity bills which makes it quite burdensome. How could it not? There were usually lines of customers to make the transaction because the process took a long time. Fortunately, there are now online transaction methods that overcome these problems. Customers are now able to pay their electricity bills more efficiently through online apps or banking channels.

After online transaction is invented, we can buy airplane tickets or train tickets in an instant since the process can be done online. With this quick payment method, people don’t have to bother anymore to queue at the payment counter, which definitely takes time. Even the price given is much cheaper than paying it on the spot.

Making online transactions to buy transportation tickets certainly saves time and adjusts it to the needs of the money you have. Payments can also be done using internet banking, mobile banking, e-wallet, and many more. A variety of payment methods to choose from will certainly make the process of buying an airplane or train ticket more practical to do.

There are many ways that can be done to pay your BPJS bill. The payment can be made using internet banking, mobile banking or through e-commerce which has become a partner of BPJS. This way, customers will find it easier because they no longer need to queue at the payment counter.

Besides that, the payment is now more practical because it can be done anytime and anywhere. Currently, several e-commerce companies that have collaborated with BPJS have begun to offer various types of bonuses to consumers, one of which is by giving cashback from their bill payments.

Paying phone bills can now be done online. Several e-commerce platforms have collaborated with various telecommunication companies to fulfill this need. Thus, the payment process can be carried out in a safe and practical way.

Those are the types of online transactions that are often carried out by people every day. With online transactions, many activities can be done quickly and easily. Now, what are the benefits of online transactions for the development of your business?

Benefits of Activating Online Transactions for Your Business

The following are 10 benefits of activating online transactions for your businesses.

- More Practical and Cheaper Than Conventional Payment Systems

- Quick and Easy Setup

- Reducing the Need for Human Resources

- Provide a sense of security and comfort for customers

- Reaching Wider Consumers Range without Limit

- Providing Payment Options and Making it Easy for Customers

- Brings Many Discounts

- Increase Customer Retention Rate

- Easier Financial Bookkeeping

- Help Stop the Spread of the Covid-19 Virus

The application of online transactions in a business will certainly provide many conveniences for customers and business owners. This is because the features provided in online transaction payments will allow the payment verification process to be carried out automatically. This of course makes the process more practical and cheaper than conventional payment systems.

In addition, customers also no longer need to send payment receipts manually and business owners no longer need to record transactions manually. This will also help business owners to minimize various types of errors that may occur due to human error.

If you accept payment transactions online, then you can adjust the payment system according to business needs. Because the online payment feature that you have can be used according to settings that can be arranged quickly and easily at any time. This is what business owners like because they can arrange online payment systems according to their respective needs.

The automatic verification process of online transactions will also reduce the need for human resources on your team to carry out conventional bookkeeping processes. This will make the work of your team easier to do. In addition, by implementing an online transaction system, the company’s human resource needs can be allocated to other jobs.

An online transaction system that is carried out with a trusted provider will certainly give customers a sense of security when making payments. This is because customers will have valid evidence when they process the transaction. For example, in an e-commerce business, the payment will not be sent to the seller when the goods have not yet been received by the buyer.

This surely reduces the possibility of fraud which is usually done by unscrupulous sellers. If your business can implement a trusted online transaction system, of course it will make customers feel more secure and protected so that it can help to improve the image of your company.

By presenting an online transaction system to your business, your customers are certainly not only limited to shops or companies. You can of course market your products or services to anyone anywhere without having to worry because online transactions allow consumers to buy whatever they want online through a website or apps.

One thing that all business owners need to pay attention to is making sure their business provides various shipping options that allow it to reach a wide area so that it can reach a wider range of consumers without any limits.

Online transactions are preferred by people in this modern era because they offer various payment methods that can be tailored to their individual needs. In addition, customers will also be facilitated with many transaction methods they can use.

Several online transaction methods that can be chosen at this time are payments through banks, credit cards, joint accounts, paypal, mobile balance, e-wallet, and many more. All of these payment methods can of course be customized with the needs and wants of your customers.

In developing a business, you must have a marketing strategy that needs to be updated regularly. One way is by presenting discounts and promos by using online transaction service. You can analyze consumer habits when they make digital transactions to make interesting offers accordingly.

Interesting offers are of course eagerly awaited by every customer since they can get the best price. This will certainly make customers prefer to transact online to benefit from the discounts offered.

To be able to make online transactions, customers definitely need to register on the website or apps that you manage. When registering, they also have to fill in some personal data such as name, delivery address, telephone number, and email address. In this case, you can also ask consumers to agree if the personal data will be used for marketing purposes in the business.

One example is using consumer email address data to send newsletters and customer satisfaction ratings. In addition, this can also be done to provide information about interesting offers.

Financial bookkeeping is necessary in a business. Implementing an online transaction system will certainly make it easier for you to make financial reports. When making sales reports, people sometimes have to do it until late at night especially if you do the conventional bookkeeping. Not only that, mistakes in calculating sales reports will also cause you a hassle.

Currently, financial bookkeeping will be easier to do because every transaction will be automatically recorded in the transaction history. Especially if your business uses a payment gateway service. Thus, you will no longer need to manually record every transaction activity with this digital system. Running a business can also be more focused on developing the business even further.

Since the emergence of the COVID-19 pandemic, all activities that allow physical contact activities need to be limited. This also includes when consumers make transactions. As time goes by, the digitization process can certainly help reduce the spread of the COVID-19 virus because now many transactions are done online.

Money can be one source of the rapid spread of the COVID-19 virus. By using online transactions, both consumers and business owners will reduce the activity of holding physical money. This can also effectively stop the spread of the COVID-19 virus when it is done.

Activate Your Business Online Transaction System With Duitku

So, those are the 10 benefits of activating online transactions for your business. If you don’t want to be left behind, activate Duitku right away. Duitku is the best friend for your online business. This Payment Gateway and Disbursement service is specially designed according to the Indonesian market. So it can be chosen as an online payment solution and transfer funds quickly.

The advantage of using Duitku Payment Gateway is that you can receive money from bank transfers, credit/debit cards, virtual accounts, and various leading e-wallet apps. You can even use it to send money to banks in Indonesia. Interesting, isn’t it? Whatever the type of the transaction, Duitku can be the best solution for your online business.

How Virtual Account Works & Its Benefits for Business

n the past few years, technological developments have grown rapidly and have brought many influences in all aspects of life, one of them is the economy sector. In recent years a lot of business is done online, shopping & making payments online. All done easily, more effectively and quickly.

Likewise, many types of payments are developing with the advancement of existing website or application-based business. Buyers can make payment transactions or transfer between banks via the internet & mobile banking, to use e-wallet apps such as OVO, DANA, Go-pay & Virtual Accounts.

All of this simplifies and saves a lot of our time because we no longer need to queue at a bank or ATM to do transfers.

What is Virtual Account?

Virtual account (VA) is an automatic payment method on an account created specifically for each customer. When making a transaction, the company will provide a VA to the customer in the form of an ID number. This number will be used by the customer to complete the transaction. Each customer transaction will be given a unique and different virtual account.

In general, there are 2 types of virtual accounts:

Fixed Virtual Account

This type of account is usually associated with a single user. With this type, users can make repeated payments to make transactions without having to enter an ID number. In short, the Virtual Account number will not change.

This type of Virtual Account is suitable for use in a business that requires customers to pay for your products or services repeatedly. For example, to pay installments for goods or a subscription on a platform, or to top up on your online platform.

For fixed VA numbers, a merchant will provide a separate number associated with each member. Then the merchant can choose to use the Closed Amount or Open Amount nominal. The difference between Closed Amount and Open Amount is in the transaction nominal. The closed amount VA displays the transaction nominal and the open amount VA does not. For the open amount VA, the transaction amount must be entered independently by the customer. The example of this is e-wallet top up transactions.

Dynamic Virtual Account

If the Fixed Virtual Account type is associated with the user account, the Non-fixed Virtual Account is associated with each payment transaction. It is characterized by a unique and random virtual account number. Only used for one transaction.

For example, when a customer wants to make a payment for your product through a Virtual Account in e-commerce, the ID number obtained by that customer cannot be used anymore to make other transactions. If the customer decides to repurchase, the system will assign a new destination virtual account number.

What are the advantages of using a Virtual Account?

Bank transfers are made to certain individual/company destination accounts. The amount will be determined by the sender and usually the sender will confirm the transfer after completing the process.

Virtual accounts are usually created for payment confirmation automation. Where usually the company will create a special virtual account to make the payment transactions. This virtual account can also contain information on the nominal that must be paid, thereby reducing payment errors (human error) usually done by the customers. This special account allows the system to check automatically every time there is incoming funds, so that the transaction status can be updated in real time.

In contrast to interbank transfers where we can process money transfer transactions at any time, virtual accounts have an expiration date. The expiry date on the virtual account is the period of validity of the virtual account that has been created. Usually, each dynamic VA number will have a maximum validity period of 24 hours.

In other aspects, virtual account transfers work just like regular bank transfers. For example, in the case of a transfer to a virtual account from a different bank. The payment method will be the same as an interbank transfer, where the customer must enter the bank code and nominal payment independently. However, the transaction will automatically fail if there is an error in the nominal entry. In addition, virtual account bills can also be paid from different countries as long as the customer has access to the payment bank account.

What are the advantages of using Virtual Account Payment?

- Detect payments automatically.

- Transaction history along with clear details for company records with bank statements or so-called reconciliations.

- Can be done anywhere and anytime.

- Type of virtual account is as needed.

- Customer does not have to own an account of the same bank as the seller.

Then, how does it work?

Here’s how the Virtual Account works:

- The merchant or merchant tells their customer to pay to a specific invoice or VA for all their transactions.

- Each Virtual Account number is directly associated with a customer or invoice.

- Every payment received, transaction information that occurs will be sent to the system and it can immediately identify the buyer or where the invoice came from.

- The system notifies the Merchant every time an invoice has been paid.

Virtual Account is a payment method that is practical, fast and easy without having to confirm payments manually. Besides that, using a Virtual Account also makes transactions more secure. If you are interested in receiving payments using a virtual account, you can use a payment gateway service to facilitate your transactions.

One of the payment gateways that have been licensed by Bank Indonesia is Duitku. Duitku accepts payments via bank transfer to a virtual account directly on the website or online apps in collaboration with various major Indonesian banks, such as BCA, BNI, Mandiri, BRI, CIMB Niaga, Permata, and many others.

Merchants can also create their own virtual account numbers based on their customer IDs. In this case you will be created a fixed virtual account. To use this feature, merchants can directly contact the Duitku team or send an email to [email protected].

Register now and try our free demo. Make your business more and more efficient with DUITKU!

Accounting Apps for Your Business Bookkeeping

In running a business, there are several things that need to be considered and must be recorded in detail, one of which is financial recording. Ideally, you should not meddle your business finance and your personal finance. You need to separate income and expenses on business needs and personal needs. Most business owners rely on their financial records only using Excel. Even though the need for financial records in running a business is more than that. That is why you need accounting apps for your business bookkeeping as a support for managing finances.

“Isn’t financial software expensive?”

The answer is no. Currently, there are many financial apps and software with good features that you can use for free. There are also paid ones but they are still very affordable for business owners. Have you used or heard of the following apps?

Buku Kas

With the tagline “Makes Your Business Easy”, BukuKas is a free bookkeeping app that can make it easier to record daily financial transactions. It has been used by more than 5 million MSME owners throughout Indonesia and spread over 750 cities. Because BukuKas is safe and very user friendly, no wonder this app’s rating on the play store has reached 4.6 stars, with 78,090 votes.

BukuKas is under PT BeeGroup Financial Indonesia, presenting one app for all needs. Not only does it make it easy for you to record financial transactions, but it also provides features for managing goods stock, making financial reports, recording and collecting accounts payable via WhatsApp / text messages to send and receive money between banks without fees or completely FREE.

Equipped with financial analysis charts to help business owners in analyzing finances in detail. It displays a real-time graph of sales, expenses and profits that can be selected and grouped according to the transaction period. BukuKas also provides digital invoices that you can send to customers via text messages and WhatsApp. If your customers make transactions offline, connect the BukuKas appwith a bluetooth printer so that the purchase receipt can be printed anywhere and anytime.

Catatan Keuangan Harian

Released on June 3, 2017, this financial management app has already been rated 4.7 stars with 17,123 votes and more than 1 million users. This Daily Financial Records app is developed by Asyncbite Software. With a classic look, they want to emphasize more on the functions and benefits that users get. With a relatively light size, 3.5 MB, Daily Financial Records prioritizes the convenience of its users.

Daily Financial Records presents quite complete features like other apps, such as recording income, expenses, calculating differences, monthly reports and others. You can also export data reports that have been entered into the application into an excel file (spreadsheet / xls), so it is very efficient and helpful when you are going to open and make a profit and loss analysis. It can also export data in the form of PDF and Text as a backup. Currently, the Daily Financial Notes application can only be used on Android-based smartphones.

Finansialku

Finansialku is a financial assistant app that will help manage your income and expenses, so you can control your finances and achieve financial goals. Developed under PT. Solusi Finansialku Indonesia, this application was released on April 11, 2017 and can be used for free. With a high commitment, the Finansialku application always fixes and updates its bugs and features. This is proven by the last update date of September 3, 2021. The rating on Playstore is also good, with more than 100,000 users, 2,163 votes and 4.2 stars.

Finansialku is a financial app that has online consulting services that have been certified by CFP (Certified Financial Planner), which has not been found in other free financial apps. In addition, Finansialku also provides complete and up-to-date information sources in the form of articles, videos and podcasts to explain various features and updates. You can also buy financial products on this app, like investment and insurance products, so you can do everything in one app.

AndroMoney (Expense Track)

AndroMoney is a free financial app with more complete features than other financial apps. With a minimalist look with proper menu placement, AndroMoney was created with a design that makes it easy to use. You will feel very familiar and easy to apply even though it is the first time you try it. So it doesn’t feel complicated when you start entering and seeing the numbers that appear in large numbers. AndroMoney’s rating on the Playstore is really high, with 260,539 votes, they got 4.9 stars.

When you open the home screen page on the application, a menu will immediately appear to access expense data, savings accounts, cash flows and budgets with storage capacity via Dropbox and Google Docs. The 4 menus will be displayed with daily, weekly, monthly and even yearly options. AndroMoney can be used for personal financial records as well, so you can sort and divide the basic budget, capital, employee salaries and others according to your needs. There is also a currency conversion feature and a data backup feature to Microsoft Excel.

Besides the features that can be used for free, the AndroMoney financial app also provides a paid/premium version. In the premium version, no ads will appear when you use the AndroMoney app. If you don’t like the display of the premium version, you can go back to enjoying the free version and without ads.

Money Lover

This application developed by ZooStudio has been released since February 11, 2011. The last update date of this application is August 17, 2021, which proves their commitment to the development of the app by following to current trends and needs. Not surprisingly, Money Lover is very popular and has been used by more than 5 million users with a rating of 4.7 stars from 182,961 votes on the Playstore. Money Lover can also be downloaded on iOS and Playstore.

The Money Lover financial recording app can help to track your expenses and business income, debit books, has reports that are presented regularly and in the form of diagrams so that they are easy to read. Besides the standard features of financial recording applications, Money Lover presents several interesting features you can use, such as:

- Posting specific budget with a reminder feature when the system detects an overspending

- Making a certain wish list post. You will be reminded of the nominal amount of money you need to be able to buy the items that you have set. This feature can make it easier and encourage saving even more.

- Easily entering shopping lists with the receipt image feature. With this, it will be easier for you to enter product material shopping expenses or other bills without having to type on the app one by one. So that goes into expenses.

- Can be connected to various bank accounts

- Bill payment reminder and bill payment report

You can use those 5 financial recording apps for free with good features. Besides providing features that you can use for free, some of these apps provide additional/premium features that you can get by subscribing to the paid version. For those of you who have a business with sales in online app or website, you can also automate your checkout payment system with a Payment Gateway. With a payment gateway, customers can transact directly on your website or online app. This way, all transactions will be neatly recorded on the dashboard, making it easier for you to summarize sales revenue for your business accounting data purposes.

Payment gateways will help your business bookkeeping reports by making a recap of all sales transactions from various payment methods. This report will be available on your dashboard page. The transaction process by customers will also be simplified because your store will be able to receive payments 24/7 automatically, anytime and anywhere. Make sure the payment gateway service you choose has obtained permission from Bank Indonesia and is equipped with international security standards, like DUITKU. Whatever the transaction, Duitku is the answer!