8 Payment Types on Online Stores to Make It Easy for Your Customers

During the Covid-19 pandemic, some policies around us have changed. Starting from PSBB

(Large-Scale Social Restrictions) to PPKM (Enforcement of Restrictions on Public Activities)

which urges people to stay at home and keep their distance. Since then, online shopping habits

are increasing. This is proven by data collected by the Indonesia E-commerce Association (idEA)

and We Are Social showing that online shopping in Indonesia has increased by 25% to 30%.

With this data, online shop owners are required to be more creative and innovative in

displaying and marketing their products. In addition, it makes it easier for customers to make

the purchase process and the payment system can also be a way to pamper them. In fact, the

complicated payment process can make customers to cancel the purchases. They might think

why it is so hard just to purchase and eventually shop at the store next door. Therefore,

facilitating customers to transact and providing various options for making payments are one of

the things you should consider.

One of the things you can do to facilitate your customers to transact easily on your website or

online application is to connect it to a payment gateway. A payment gateway is a payment

channel that connects merchant websites or online applications with financial service

institutions such as banks, e-wallets, credit card transaction managers, and many others.

The following are various payment options for online stores that you can open using a payment

gateway:

1. Bank Transfer (Virtual Account) – ATM, M-Banking, I-Banking

The old way of making transactions is to transfer payments via ATM/M-Banking/I-Banking

directly to the seller's bank account. This payment is so familiar that it is often used in online

shopping. The weakness of this payment method for sellers is if in one day they receive a lot of

payments, it will be bothersome and time-consuming to verify the order. Therefore, the current

Virtual Account system is more in demand.

A virtual account is a specially generated number for customer payments that usually lasts only

24 hours. This number contains Customer ID information data and the amount of money to be

transferred. When the customer enters the virtual account number, the name of the customer

and the total price will appear. So for customers, the payment process is easier, no need to

manually type in the destination account number and nominal. The security of the transaction

is also maintained since a virtual account payment method can reduce the risk of transfer

errors. For sellers, they will get confirmation reports automatically of which customers have

successfully made payments with the right nominal.

2. Card (Debit/Credit)

Payments using a Debit/Credit card do not only rely on an EDC (Electronic Data Capture)

machine where you swipe your card on. You can also pay for your online shopping by paying

with a Debit/Credit card. Using it is very easy, just enter your Debit/Credit card data into the

payment service such as card number, CVV (Credit Verification Value) number and card validity

period, and the transaction will be automatically done. If you make a payment using a debit

card, the transaction will be directly deducted from your savings account, and when you use a

credit card, your transaction will be counted as a debt or credit card bill.

Credit cards are known for the most risky payment method due to a high risk of data theft.

Check out this article (https://www.duitku.com/saat-5-hal-ini-before-menerima-payan-kartu-

kredit-online/) for tips on using credit card transaction method safely and securely.

3. Digital Wallet (E-Wallet) – Gopay, Dana, OVO, LinkAja, TCASH, Jenius, Paypal

You must have often seen advertisements on TV, Youtube and even Tiktok about how easy it is

to make payments using OVO, Gopay and Dana. These examples are what we call ‘E-Wallet’, a

transaction without using physical money. With only a cellphone, you can make transactions

with Digital Wallets.

So, a digital wallet or E-Wallet is an electronic application service with a system for storing

payment instrument data, for storing funds and can be used to make online transaction

payments. No need for cash or card.

4. QR Code Payment – QRIS

QR Code Payment is an online payment where we scan the barcode provided by the

seller/online shop. This makes it easier for people and avoids mistake made by customers to

enter the seller's account number. Just enter the amount you need to pay and click ‘send’.

Make sure the internet connection on your smartphone is available when you scan the

barcode, because it usually requires a stable internet connection to be able to transact with QR

Code Payment.

In 2020, Bank Indonesia established QRIS (https://www.duitku.com/apa-itu-qris-dan-apa-saja-

keuntungannya/ ) or Quick Response Indonesian Standard, which is a QR code that can be used

on mobile banking and e-wallet apps. This payment method is growing rapidly and favored by

merchants because of its convenience and very competitive prices compared to other payment

methods!

5. Online / Paylater Loan Providers – Indodana, AkuLaku, Kredivo

Not everyone has a credit card, but sometimes people also find it too burdensome to pay in full

payment. It could be because the amount to be paid is bigger than the money you have or

when a sudden need arises. In those kind of situation, people will look for the fastest and

easiest solution, one of which is by applying an installment account without a credit card.

Installment services without a credit card are money loan services provided by online-based

financial services. Online loan service providers are the examples of innovation in financial

technology. With a very easy way of registering, where usually only requires an ID card and a

phone number, you can get a loan limit without collateral in just clicks away.

6. Payment via Retail Outlets

More and more retail outlets have sprung up in various regions which can also be used as an

online business payment system. Customers can make payments in cash at retail outlets with a

unique code that has been generated on the website or online store app where they shop.

Therefore, customers who want to pay with cash are facilitated as well. Sellers will also feel

secure and the efficiency when they receive an order. Usually, this payment method is very

crucial to reach customers who does not have a bank account and e-wallet in Indonesia, where

those who have them are still in the range of 40%.

7. Direct Debit – BCAKlikPay, OCTOClicks, e-PayBRI

Direct Debit is a payment system where you can authorize customers

(organizations/institutions) to be able to withdraw money from your registered bank account

automatically or when a previously registered payment is due. This method is the most simple

and most convenient when you have a list of recurring payments, such as BPJS Health

payments, monthly fees, mandatory savings, etc. However, the institution must still give an

advance notice of when to withdraw and the amount to be withdrawn.

8. Cash On Delivery (COD)

Lately, there has been a lot of viral news about customers scolding couriers when they buy a

product using the COD payment method. To some of you who are still don't know what is COD

payment method, it is an abbreviation of the term Cash On Delivery. The term COD used to

refer to the sale of goods online, but the receipt of goods and payment required the seller and

customer to meet at an agreed location and time. This has drawbacks and is not effective if the

customer’s location is too far from the seller. Although this one payment method is not

included in the payment methods offered by a Payment Gateway, this method is very

interesting for you to know.

However, online shop owners who join the marketplace can still use this COD payment system

even though customers are far from their location. The COD process which is usually carried out

by the seller and the customer become carried out by the courier and the customer. The

customer can ensure that the ordered goods have arrived and make payment in cash to the

courier who delivered the package.

All payment methods for online shops or online shopping above are currently provided in one

payment gateway system. Just register an account and you can immediately open the various

payment methods above. So easy, isn’t it?

By using a payment gateway, sellers do not need to take time to do manual checks through M-

banking or I-banking. The advantage for customers when shopping online at an online store

which uses a payment gateway is that it is easier to make payments via various payment

methods and can be processed 24/7. Usually, shopping on a website that is connected to a

payment gateway also makes customers feel more secure in completing the transactions, since

to join and activate a payment gateway account, merchants are required to provide their

personal data such as ID card, NPWP, account book, and others. If any of the required

requirements are invalid, then the seller cannot activate a payment gateway on their online

store.

Finally, make sure the payment gateway you choose has officially received a permission from

Bank Indonesia and has an international standard security certificate like Duitku. Let Duitku

take care of your transactions!

Apply These Strategies to Increase Your Business Transactions

Increasing sales turnover is not easy, especially in the midst of a seemingly endless

pandemic situation. Many business owners try to apply various methods to maintain the

sustainability of the company, from streamlining the production process, providing extra

services, to applying various marketing techniques.

To apply the right marketing techniques, you need to prepare a sales strategy so that

business transactions can be increased. Even better if the strategy is prepared before

your business starts.

So, what are some effective sales strategy to increase business transactions? There

are 4 tips that you can apply so that your business will gain more profits

1. Improve Product Quality

Basically, there are 2 things that you need to consider in selling, namely products

quality and price competition. If you don't want to compete in terms of price, you can

improve your product quality so you can still maintain sales profit margins.

Product quality plays a role in increasing sales turnover in online and offline stores. If

your product is high quality, customers will definitely not hesitate to repurchase your

products or even promote your product for free to the people around them.

Therefore, it is very important to do a quality check before the product is distributed so

that the reputation of your store is maintained. Surely you don't want to lose customers

just because of manufacturing defects, right?

2. Branding Optimization

Besides improving product quality, you need to understand the importance of branding

for businesses. Branding is a way to provide superiority or uniqueness to customer

perceptions so that they can be a regular customer.

Strengthening brand awareness (branding) is one way to increase online business

transactions. With a strong brand, you will no longer need to be afraid of competitors

who have similar products with yours. Customers will definitely choose to continue

transacting with your business.

Therefore, optimize your branding by involving customers in every promotion. This

method can place your business brand on top of every customer’s mind.

3. Promote Products

In increasing sales turnover online, there are various ways to promote products, one of

the most popular media to promote your retail products is via social media. The reason

is because there are lots of novice business owners who have succeeded in increasing

business transactions up to many times their capital just by using social media.

This is because social media is a platform that has a wide audience and is never empty

of visitors. Especially platforms, like Instagram and TikTok. These two platforms have

the potential to boost your online sales if you can make the best of their use. Therefore,

start updating your business social media regularly by using the special features

available to increase business profits.

4. Integrate Business Checkout System

Many people sometimes do impulsively buying, so if a customer cannot buy right away,

they may forget your products later on and switch to another product or store. To avoid

this thing to happen, you can implement a seamless shopping experience by providing

digital payment options for online businesses.

By integrating a business checkout system, customers can make transaction 24/7 and

you can provide a comfortable shopping experience so they will complete their

transactions easily. This way, it is surely easier for customers to complete purchases in

your store and they most likely will do a repurchase later on.

In addition, various digital payment methods can increase security and convenience for

customers so they may be back to do a transaction on your store. You can use a

payment gateway as an option to support various online payment methods without

having to open multiple accounts. With a payment gateway, you can also see all

transaction reports in one dashboard so that sales recording will be in order.

Those are the 4 ways to increase your business transactions. Lastly, make sure to

integrate your business payments with a payment gateway that has obtained

permission from Bank Indonesia and has a PCI-DSS security certificate, like Duitku, to

improve shopping experience for customers.

With a payment gateway, you will no longer need to wait for payment receipts from

customers because all payment will be confirmed automatically. Moreover, customers

can also choose the payment options they favor.

Start creating opportunities to increase your sales turnover by starting a transaction with

Duitku !

What is Chargeback and How to Avoid It?

When one use a credit card as a payment method, there are sometimes problems during the payment process. One of the problems that usually occurs is chargeback. What is chargeback? The term chargeback means that there are amount of money that are being hold by a bank due to a dispute during transaction using a card. For online sellers, this condition definitely can hinder the payment process.

Get a Better Understanding about Chargeback

When shopping online, buyers usually make transactions using a payment system via a bank, either by direct debit or a credit card. However, payment methods made via banks or by transfer systems sometimes have a problem, like chargeback, that are detrimental to business owners or sellers. This condition of chargeback can occur accidentally during the transfer process.

There are several things that cause a chargeback, such as transaction errors and when there is a difference between the signature on the receipt and the signature on the credit card.

The bank will stop the transaction process if there is a difference in signatures to prevent transactions carried out not by the real credit card holder. The occurrence of a chargeback can also due to an error in the date or nominal, or repeated transactions (double transactions). In addition, chargeback can also occur when credit card holders feel dissatisfied with the quality of the goods they bought so they issue a complaint to the bank.

This condition can be solved by submitting a report to the bank, so that the money is no longer held by the bank, though sometimes this reporting process takes time so buyers and sellers can sometimes experience some losses before their money back.

Disadvantages from a Chargeback

This condition where some amount of money are being hold by a bank causes the payment that should have received into your bank account eventually canceled due to a chargeback. As a result, your financial records could become rather messy, because the money is stuck and even worse, it could stagnate your business. This, of course, does not only reduce your profits, but also your income. Therefore, it is very important to avoid chargeback risk reported by the buyer that can disrupt your business from running smoothly.

How to Avoid Chargeback

There are several things you can do to avoid a chargeback that can cause you a loss as a seller or a business owners:

- To minimize complaints from buyers, they must pay attention to all the information that appears in their invoices. Such as the nominal, the source of the withdrawal of the money, and the date of the transaction being made before they continue the payment process. Buyers have to ensure that the information displayed at checkout is transparent and clear.

- Make sure the seller provides detailed information regarding the product being sold. The product descriptions, images and features must be in accordance with the real condition of the products. Sellers must also response to product information questions by the buyer.

- Explain what terms and conditions apply on your invoice and website in case you have to refund or when buyers want to return the products.

- Recognize and be aware of signs of credit card fraud by checking the original address of the card registered by the buyer, especially if they make a large order. It is recommended to send an email to confirm the status of the order.

Keep all transaction history and communications with buyers, so when you file a report, you have a solid evidence to protect you against credit card chargebacks. - It is recommended to provide a safe and realistic estimated delivery time. Use a trusted expedition service that has an online tracking service. Add insurance service if you want to extra security system, so that buyers will feel more secure about their purchases.

- If the dispute is caused by the buyer’s misunderstanding, make sure you, as a seller, understands the problem. You must also offer a solution that is acceptable to both parties to avoid a credit card chargeback report.

- Using a fraud detection system. You can ensure that the credit card received has used a 3D secure authentication code to ensure that the card user matches the registered card owner. Banks use this security system as a proof of chargeback protection for credit cards.

To receive payments from credit card safely and directly on your website or online app, you can use a payment gateway service. But make sure the payment gateway you are using has a PCI-DSS certificate (international security standard for managing credit card transactions), and is equipped with a fraud detection system (FDS). By using a payment gateway with a good FDS, you can protect your online business from theft or fraud by setting the nominal transaction limit, selecting the allowed transaction region and block suspicious card numbers.

One of the best payment gateway services that has a license from Bank Indonesia and has a PCI-DSS certificate is Duitku. Besides accepting payment systems using credit cards, Duitku also facilitates customers to pay using various other methods such as e-wallet, bank transfer, retail outlets (Indomaret, Pos Indonesia, Pegadaian, Alfamart), installments without card, or other payment methods. You can choose the payment method you want to provide for your customers on the Duitku dashboard.

By integrating a payment gateway service to your website, you can process payments in real time automatically. The secure, fast and easy transaction payment process provides a pleasant online shopping experience for customers, and therefore can encourage customers to make product purchases.

Start accepting payments via credit card using Duitku payment gateway now and let us take care of your transaction!

Tips for Digital Transactions during a Pandemic

Digitalizing the financial services industry is very important in maintaining this country’s economic growth even during the pandemic. This is because digitalization can make a positive contribution to society and MSMEs in Indonesia.

To that end, in Bank Indonesia Regulation No.23/6/PBI/2021 about Payment Service Providers (PBI PJP), Bank Indonesia seeks to strengthen the digital ecosystem in Indonesia by creating a fast, easy, and secure payment system, while still prioritizing protection for consumer. In this way, Bank Indonesia hopes to realize an inclusive digital economy and finance acceleration.

Although Bank Indonesia has implemented regulations regarding payment service providers, it does not mean that you don’t need to pay attention to things when making digital payments. You can apply these 3 tips for conducting a safe online digital transactions for your customers, which Duitku has summarized in this article.

Choose a Trusted Hosting Server

If you make a business-only website, choosing a trusted hosting server is a must because hosting affects how easy customers in accessing your website.

Choose a trusted hosting server that has a technical team ready to help you 24/7, including holidays. Therefore, your website server is monitored at all times. In addition, make sure the hosting partner you choose provides data back-up services, so that if something unexpected happens, you can restore the data on your website.

Get SSL Certificate

To increase the security of your customer transactions, make sure your website is equipped with an SSL certificate. The use of this certificates is very important since they protect your website from customer information leakage, such as personal data, credit card information and transactions, and transfer history.

Check Transfer Receipts

Double-check payment receipts provided by the customer before sending the product. This is because there is currently widespread falsification of transfer evidence that is surely detrimental to business owners. If your business still accepts payments manually, you can use an online payment system that can automate payments 24/7 and be able to record detailed business history of income and expenditure transactions to minimize frauds.

Those are the three tips for providing a safe digital transaction during the pandemic. To convince your customers to make online payments on your online store, use Duitku Payment Gateway in online transaction/payment for your business. Duitku Payment Gateway is equipped with a Fraud Detection System and has met the PCI-DSS security standard to protect important data on customer’s credit card transactions. In addition, all transactions on Duitku are monitored by Bank Indonesia so that the digital payment process is safe and convenient

Let’s try one transaction with Duitku and feel the benefit for your business!

Provide QRIS Payment Option for an Easier Transactions

Non-cash payments are currently emerging as the world’s technology advances. Not to mention because of the current COVID-19 pandemic, the non-cash transactions are excellent option because they are deemed more practical and hygienic.

Due to the high level of digital transactions use, various payment methods have also emerged, one of them is QRIS, which makes it easy for offline businesses to facilitate your customers’ needs by switching to digital transactions. With the Indonesian Standard of QR Code by Bank Indonesia (QRIS BI), business owners are able to accept various types of non-cash payments so that transactions are faster.

Interestingly, QRIS can also be used for online business transactions. Just scan the QR code, enter the nominal payment, the transaction can be completed quickly as long as there is an internet connection.

Let’s read the following article to find out more of how QRIS payments work to make business transactions easier!

What is QRIS?

QRIS is a QR code designed by Bank Indonesia as a digital payment standard for every business owner who provide payments using QRIS. With the Indonesian Standard of Quick Response Code (QRIS), all QRIS payment transactions can be done with one QR code since everything is integrated in one system. This has also been regulated in PADG No.21/18/2019 about QRIS as an International Standards for Payments, so that digital transactions become safer, faster, and more practical.

QRIS Payment Options

Do you know that QRIS has two types of payment, which are Static QR Code and Dynamic QR Code? These two types are divided based on the type of QR and its use.

Static QR Code is a fixed QR code (it cannot be changed) and contains a link to a fixed web page. This static QR is suitable for offline or retail payments because the transaction nominal is input by the customer manually when making payments so the confirmation is also done manually.

In contrast to that, the Dynamic QR Code can be changed in real-time so that the QR Code will be different for each transaction. For example, you make a transaction on an online business website. With the Dynamic QR Code, the transaction amount will be available automatically when you are about to scan. Due to the dynamic/unique nature of

QR, the system can use this data to check and verify if the payment has been made. Transaction record will also be organized in order and the risk of human error will be reduced.

How much does the QRIS cost?

QRIS requires a fee in every transaction. Surely, this transaction fee has been approved by Bank Indonesia so that the costs incurred are the same for all businesses. In order to get an idea of the transaction fees issued by QRIS, let’s compare the costs required for other digital wallets in one transaction.

QRIS: 0.7% of the nominal amount of shopping / transaction

Gopay: 2% / transaction

OVO, LinkAja, Funds: 1.5% + 0.15% (VAT) / transaction

ShopeePay : 1.5% / transaction (ShopeePay MDR will change to 2% starting March 2022)

From the data above, it can be seen that the rates offered by QRIS are more affordable so that merchants will not be burdened by a high transaction fee.

How to Use QRIS

Before implementing the QRIS payment method to your business, merchants need to collaborate with an app provider who provide a payment option using QR code. Once the collaboration is set and approved, QRIS can be used at all merchants who collaborate with payment system service providers, such as various banks that have facilitated m-banking (BCA, Mandiri, CIMB, etc) and various e-wallets (OVO, Gopay, ShopeePay, etc). With just one QR code, business owner can accept all payment methods according to customer’s choice.

Benefits of using QRIS for Merchants

By providing a variety of non-cash payment methods, business owners can increase sales traffic so as to generate maximum profits. In addition, switching to an online business makes cash management smaller, your business does not need to give change so it minimalizes the risk of loss due to lost/counterfeit money.

Now, have you got a better understanding about QRIS payment method? With a single scan of the QR Code, you can provide convenience to customers by accepting payments through various e-money channels. Click here for more information about the QRIS payment method

If you have an online store, don’t forget to integrate your website with a payment gateway so that your business has a variety of automated payment methods which surely makes transactions more practical and faster. You can use Duitku Payment Gateway to enjoy the convenience of a quick, neat, and secured business transactions.

Duitku has been licensed by Bank Indonesia and equipped with a PCI-DSS security system, so let us take care of your transactions!

5 Ways to Increase Customer Satisfaction

For online business, increasing customer satisfaction is a must since customer satisfaction can be a measure of the success of a business. If the customer is satisfied, it is possible that the customer will return to buy the product/service offered and invite people around them to buy the same product.

There are 5 ways to increase customer satisfaction you can do so that you get a better chance of customers to repurchase products on your online store. Check out the tips below!

1. Listen to Complaints and Suggestions

Your customers issue a complaint? Listen to them carefully and record the complaint. A complaint indicates that there is an imperfection in the product/service you offer so you need to fix it immediately.

Don’t forget to pay attention to these complaints and take action. By following up on complaints, customers will feel valued for their opinions which will give an impact on their satisfaction.

2. Extra Service

Generally, people are interested in buying products after seeing the promos offered. Therefore, offer extra services by giving special discounts or promotions, either to new customers or the regular ones.

3. Serve to Them Friendly

Hospitality is one of several indicators of customer satisfaction. Therefore, make sure customers get the best service by showing friendliness and ensuring that the delivery process is on time. Your customers will definitely be satisfied with the service you give.

4. Easy Payment

Make the best use of technological advances like Payment Gateway to provide various payment methods directly on your website or app, such as debit cards, credit cards, to digital wallets (e-wallet). By providing various payment options, customers can choose to pay in full or in installments so that your products will be more affordable to many people.

With a payment gateway, you also make it easier for customers to buy your products since they can make transactions 24/7 without waiting for your response. This surely will make customer satisfaction increases since midnight online shopping is no longer a problem.

5. Provide Security Guarantee

Maintaining customer trust is a must. For this reason, provide product security guarantees and transaction service, so that customers will continue to use the products/services that you offer and do not move to other stores.

Most importantly, don’t forget to integrate your store with a payment gateway that is equipped with a fraud detection system to detect fraud in every business transaction, like Duitku.

With Duitku Payment Gateway, all transactions can be processed automatically 24/7. You will immediately get a transaction notification without waiting for customers to send the transfer receipt.

Start integrate your business with Duitku to increase customer satisfaction and loyalty.

Let Duitku take care of your business transaction!

Are You New in Online Business? Try These 6 Business Ideas and Tips for Maximum Profits

Online or digital entrepreneurship is currently trending. With the outbreak of the COVID-19 pandemic, business owners are demanded to be more creative in finding the right way to remain able marketing their products to consumers.

Not only experienced business owners who already know the ins and outs of the business industry, beginners who are mostly just ordinary people with no background in business who have just been affected by the mass lay off thanks to the pandemic also have the same anxiety. One solution that is quite promising and very easy to do, especially for beginners, is to run your own business at home online on digital platforms.

This method definitely works so if you want to survive and support yourself and your family in the midst of the Covid-19 outbreak that is still going on in Indonesia. For those of you who are interested in setting up a personal online business but are still not sure yet about what online businesses are promising and easy to do at home, we have presented some examples of online business just for you.

Selling Internet Data and Electric Credit

In the past, people had to go to the credit counter or ATM to buy credit and internet data. Nowadays, everything can be done online without any hassle. You don’t need to rent a place to make a counter, because during a pandemic like this you can also do everything from home. You can try to become an electric credit payment agent as well as an internet data top up service provider. How to do it is very easy. All you have to do is look for internet data and electric credit vendors who specifically sell credit to resellers at low prices. Usually, vendors like this are widely available in online shopping portals.

To make your internet data and electric credit service business run smoothly, do regular promotions with interesting prices on all your social media, be it to friends, family or in communities on your various social media portals. So, for those of you who are still not sure about what type of online business you can try, this service for selling electric credit and internet data might be the best answer for you.

Culinary (Cookies, Homemade Side dishes, Snacks, or Drinks)

The culinary world lives on, whether it’s the food or beverage business. In any case, the culinary business will always be in demand because all humans need to eat and drink every day. This has been proven by the variety of culinary types being sold, ranging from cakes, home side dishes, snacks, pastries to fruit salads. There are also beverage businesses that are definitely interesting to try, such as fruit soup, coffee, tea, milkshakes, or juice.

This business opportunity is very promising, especially for beginners because in the midst of a pandemic like today, a culinary business can become a potential home-based business and can give you many benefits. If you and your family have a talent and passion in baking or cooking, there’s nothing wrong with trying to turn those talents or passion into profits.

Online Course Tutor

Schools and universities being closed during the pandemic has made the educational process rather not run smoothly. Students are demanded to be able to study independently at home. Although there are video call schedules with teachers and lecturers, the in-person teaching process in the classroom is still way more effective.

A situation like today is actually very promising for those of you who have graduated and master a certain subject such as mathematics, geography, or English. Not to mention if you have previous teaching experience. This can be an extra point for you because you can easily share course material that you have previously received with course participants. They will also be very helpful with this.

Software and Ebook Sales

It is undeniable that during the pandemic people have become more and more aware of technology and its products. For example, before the pandemic, people had to go to a bookstore or order a book through an online store to read them, but now people are starting to realize that reading ebooks is much easier because it can be done anywhere and anytime.

Nowadays, there are so many various types of Ebooks, ranging from conventional books such as fiction and non-fiction to course materials that we may not find offline in any bookstore in Indonesia. Furthermore, due to the pandemic that has made many people dependent on technology, the sale of digital software has become increasingly popular. For those of you who are just getting started, this business is definitely very promising to try. Besides not being too complex since you don’t have to prepare the product in its physical form, you can also save a lot of money.

Health Equipment (Masks and Face Shields)

If we see the death rate and the number of patients of Covid-19 which continue to rise in Indonesia lately, the business of health equipment such as masks and face shields can be a big opportunity to make profits. You can ask your family members to join you in producing masks and face shields at home.

Besides helping your family financially, you have also taken part in helping people to be protected from this deadly virus, especially if the price you offer is more affordable than the products sold by large factories in the market. However, don’t forget to pay attention to the raw materials and standards of masks and face shields that you want to sell. Participating in online mask making training from several institutions can be a good start for you to be able to do this business.

Cleaning Products Business (Hand Sanitizer)

Before the pandemic, most people were not very aware of cleaning products like hand sanitizers or etc., now this type of product is in high demand. This can be a promising opportunity for you as a startup entrepreneur.

If you can’t make or produce your own cleaning products, you can still do business online, for instance, by becoming a dropshipper or reseller of these products for resale to the public since the profit from this business is pretty huge.

One important tip for you if you want to become a reseller is to look for a manufacturer of cleaning products that is trusted and provides low prices so that the profit margin you receive is even greater. Also make sure that the products you are going to resell have been properly understood beforehand.

If you have decided what online business to do, then in order to run optimally and make profits as expected, it is very important to know what tips to follow in order to get the results you expect. Here are some effective free tips you can try.

Know Your Business Challenges In Advance

No matter how big the scale of the business, small or large, make sure to first identify your business challenges. This is very important so that if something unexpected happens in the future, you can immediately find a way out and even be able to grow from it. For those of you who are in the home business with non-digital products that are marketed online on social media or personal websites, make sure that you have considered challenges such as the availability and ability of adequate human resources in advance. For instance, train the employees who are new to operating technology or digital platforms.

As it is known that the use of technology is very important today since on digital world you can save a lot of money on marketing your products. Online or digital marketing has more advantages than the conventional marketing methods that are usually done in general. Those advantages includes its ability to reach every segmentation of consumers and the market area being targeted by the product is wider so your business can grow exponentially.

Be Creative and Innovative

There are countless types of businesses in the world. There can be dozens of business owners involved in just one type of business. For instance, the business of selling clothes online. Each seller must has their own characteristics for the products they sell. For example, businessman A sells women’s and men’s clothes made of knitwear. Businessman B specializes in selling Muslim robes and clothing, and businessman C who prefers to sell T-Shirts and casual clothes for exercising.

From that example, we can learn that various types of clothing business has to always be in line to current trends, creative and observant in seeing opportunities, and being able to continue to adapt and innovate so that your products have a unique selling point to consumers. As a result, your product will survive or even lead the market competition with other products that already have a large market and have entered the clothing business before you. The point is you need to show that your product is unique and different from others.

Have Your Own Personal Website or Online Store

Creating a personal website for business will definitely be more complicated than renting an online store in a large marketplace like Tokopedia, Bukalapak, or Lazada. However, starting your own business without a third party intervention where you have a complete control over everything is one of the most effective ways to get you to market your products as freely as possible.

For those of you who choose a business selling digital goods like selling electric credit, internet data, ebooks, and software, this way will make all of your transactions with customers easier. Not to mention if you choose to sell a home product business like culinary or clothing. Having your own website or online store can make it easier for you to do all kinds of marketing, promotions, and transactions.

Install Payment Automation and Trusted Transaction Recording on Your Website or Online Stores

The next thing that must be considered after having your own website or online store app is to install a payment system that is easy and reliable to be used in making transactions. The system in question is Payment Gateway (PG). For those of you who are not too familiar with payment gateway, it is a payment system that can be defined as a modern payment method that can run automatically and can be integrated directly on a website or personal app. By installing a PG directly on your website, payment transactions for services and products between you and consumers will be easier.

PG will connect your personal website or online store app directly to the related financial service provider, for example a bank, e-wallet application (OVO, Dana, etc.), or also providers for installment without a credit card (Kredivo, Indodana, etc).

For those of you who sell digital goods in the form of software, ebooks, or credit, this transaction process will really help your business. If you have set up an automatic product distribution system at the beginning as soon as the payment notification is received, then as soon as the payment notification from the customer is received by the system, your digital product will be immediately sent by the system to the customer without having to spend a lot of time waiting for the transfer process.

For a home business that is marketed online, payment gateway will definitely make it easier. No more trivial and time-consuming hassles like chats from customers asking how much the price is, or how to pay and send transfer receipts, and etc.

Now, with the various advantages offered by this automatic payment system, how do we choose and install this accurate payment automation system on your website? First, make sure that the PG you choose is officially licensed by Bank Indonesia. Second, check whether the PG has met international safety standards or not. One of the payment gateways that meets these two criteria is Duitku. With Duitku PG system that has been trusted and standardized by Bank Indonesia, all your transaction reports will be fully recorded in the Duitku app, so when you need the report, you can just download it on the Duitku Dashboard! It’s so easy, isn’t it?

Are you still unsure to do an online business because you are worry about the hassle when making transactions with customers? Try using Duitku now and feel the long-term benefits for your business growth in the future.

Here’s How to Join the August 17 Offer by ShopeePay

The national holiday of Independence Day of Indonesia on August 17th is almost here, even though we should still #stayathome, many promos or shopping discounts are starting to be offered to celebrate this national holiday. Usually, people’s shopping habits is increasing as the holiday promo is approaching. As an online business owner, you shouldn’t miss the opportunity of this momentum, especially for those of you who have a local product business. Let’s check out the promos you can do below with a co-funding promo offer by ShopeePay

Are you familiar with the Shopee app? Shopee is the marketplace app with the most users in 2021. One of the reasons is because this app often has many interesting discounts and offers. Therefore, many deal hunters come to visit it to seek for promos!

In the occasion of Indonesia’s Independence Day celebration in the 17th of August, Shopee will be holding a promotion event called 17.8. Even if you don’t have an online store on the Shopee app, you can still join this event and get benefits from it as long as you accept payments with ShopeePay. In fact, this way you can also advertise your online business on the Shopee platform to direct potential buyers to find your brand and visit your online business website!

website vs marketplace what’s the difference?

What promotions are Available on ShopeePay?

To celebrate Indonesia’s Independence Day, Shopee will present a promo called 17.8. This promo will take place on 9-17 August 2021, the promo will peak on 17 August 2021. Before the event takes place, Shopee will advertise this 17.8 promo on their social media accounts and platforms on 6-8 August.

What is the Form of the Promo?

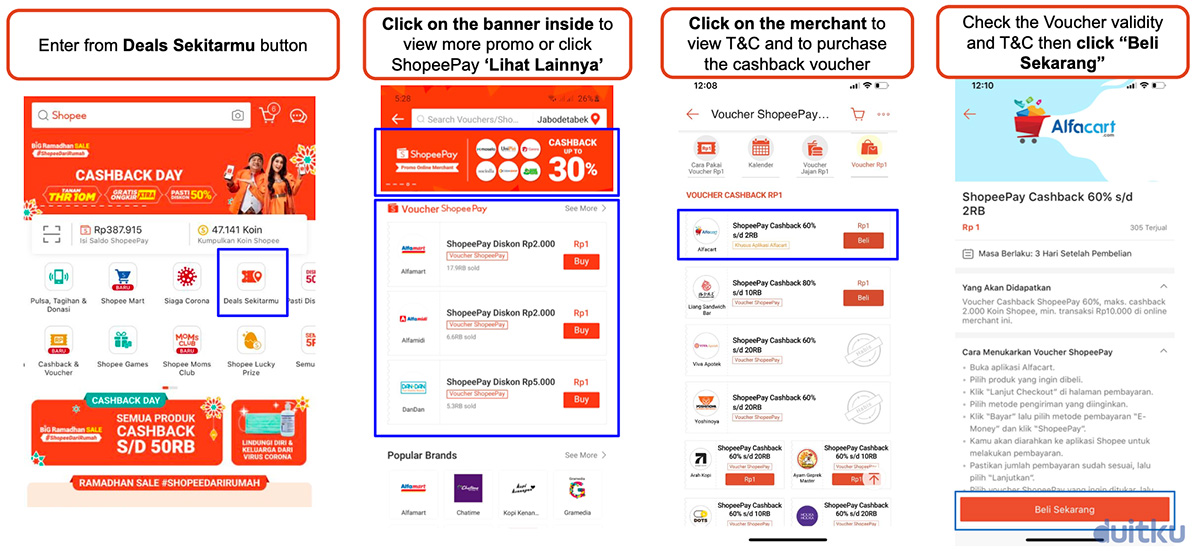

This Shopee marketplace app has several sub-menus on its homepage, one of which is the “deals around you” menu.

- Enter from Deals Sekitarmu button

- Click on the banner inside to see more promo or click “ShopeePay”, “Lihat Lainnya”

- Click on the merchant to view the T&C and to purchase the cashback voucher

- Check the voucher validaty and T&C then click “Beli Sekarang”

When you open the menu, you will find a wide selection of promo coupons for IDR 1,000 that you can use at the store you choose. This promo coupon has several values as well, usually, merchants offer 60% to 80% discounts with a maximum nominal ranging from 12 thousand to 17 thousand rupiah.

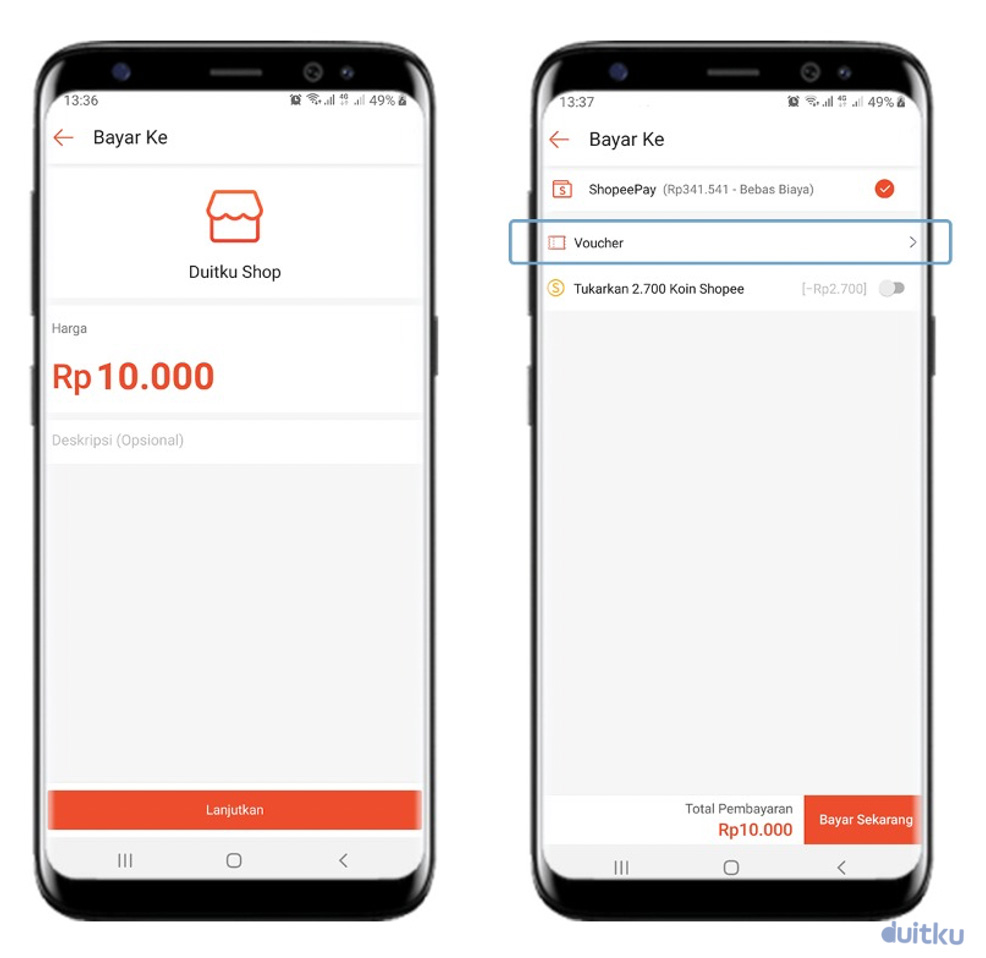

How Do Customers Use This Voucher On Your Website?

This voucher can only be redeemed online when the customer pays using the ShopeePay payment method. When they checkouts on your website or online app, the Shopee app will send a push notification on the customer’s phone and they will be redirected to complete the payment on the Shopee app.

- The store name and transaction amount will appear on the Shopee appl, select the “Continue” button

- Select the voucher menu to use the previously purchased voucher. The voucher option will appear and the bill amount will be deducted automatically.

Besides attracting more shoppers, if you decide to join this partnership, you can also get the opportunity to promote your business directly on the Shopee app and Shopee’s social media accounts.

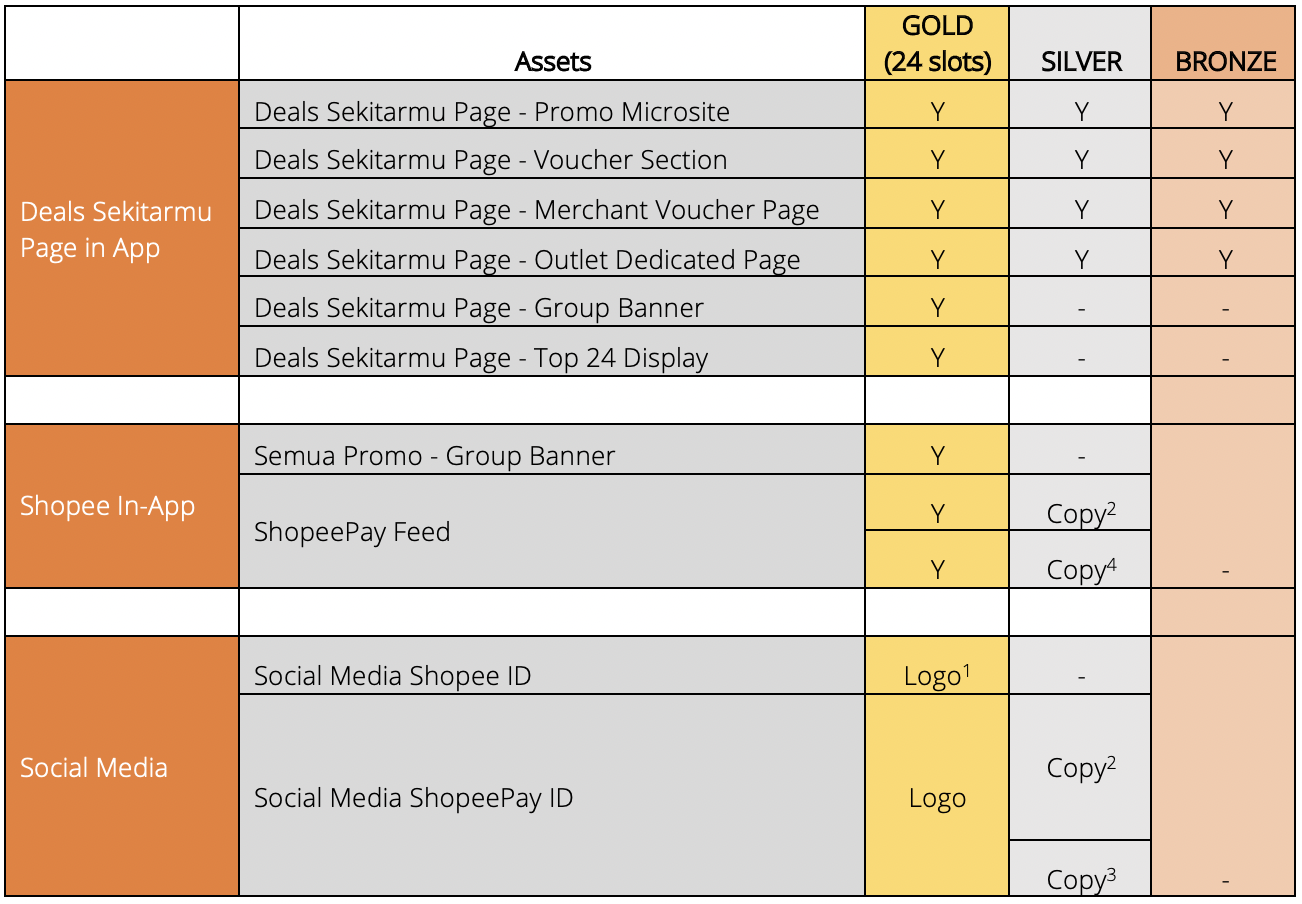

Shopee offers promos in the form of co-funding, where merchants and Shopee jointly finance price promotion offers for customers. The following is a list of prices offered by Shopee. The more you give discounts to your customers, the greater the exposure given to your online store!

Direct/Voucher Cashback ShopeePay 60% / 80%

How to Register?

Are you interested to join this 17.8 ShopeePay co-funding promotion event? To take part in this event, you only have to open the ShopeePay payment method on your website or online app! And to open the ShopeePay payment method, you need to integrate a technology called Payment Gateway so you can receive payments directly on your website or app.

A payment gateway will connect your personal website or online store app directly to the related financial service provider, for example a bank, e-wallet application (OVO, Dana, etc.), or also providers for installment without a credit card (Kredivo, Indodana, etc).

Don’t forget to make sure that the Payment Gateway you choose is officially licensed by Bank Indonesia and meets international security standards like Duitku. For those of you who already have a Duitku account, you only have to send an email to [email protected] or contact us on live chat on the dashboard to register your store participation for this 17.8 promo. And for those of you who don’t have a Duitku account, don’t worry! With only your ID card and Taxpayer Identification Number, you can register your website on Duitku! If you feel that you are not ready yet because your online store doesn’t have an adequate website yet, don’t worry! Just register your online store at Duitku and keep up with information of interesting promos in the Duitku newsletter.

#StartwithOneTransaction and get the long-term benefits for your business growth in the future!

Tips for Choosing an Cardless Online Credit Service

Nowadays, many companies in financial and technology sector provide online credit apps. This phenomenon is happening for a reason. The cardless online installment is chosen based on the interest of users who want to buy something but do not have a sufficient money to buy it.

These online credit apps also offer many conveniences, such as the practicality of the apps (e. g. users do not have to be a customer of a particular bank to make a loan) to the availability of loan simulations to estimate the amount that must be paid every month.

If you are interested to use an online credit app, you can apply these tips for choosing an online loan by Duitku in the article below so your installments will be secure.

1. Choose a Trusted Institution

Before choosing an online credit service without a card, make sure that the online credit app you use is on the list of trusted financial institutions. If it is registered and supervised by the Financial Services Authority (Indonesian:

Otoritas Jasa Keuangan/OJK), then the security of your data is guaranteed to be safe so it is more secure to make transactions.

2. Check the Credibility of Lending Institutions

After knowing the online credit service without the card that you choose is registered on OJK, the next thing you need to check is the credibility of the loan institution. Look at all the terms and conditions contained in the agreement or contract provided by the institution.

For example, the interest policy charged according to OJK rules should not be more than 0.8 percent per day or 24 percent per month. If they give the amount of interest that is more than the OJK rules, it means that the credit provider of your choice is less credible, so it is suggested for you to choose another institution.

3. Don’t be Easily Tempted by a Small Amount of the Down Payment

Besides being easy and fast, online credit services without a card often offer a small amount of down payment program to attract potential users. Be a smart user by not easily tempted by the promo offered. Reconsider whether you really need the loan or just want the promos offered. In addition, re-check your financial expenses before deciding to take a loan. Make sure the maximum installment paid every month is no more than 30% of your monthly income. Don’t let your monthly expenses out of hand due to the additional installments.

4. Decide the Budget

Before taking a loan, determine the installment budget by adjusting it to your income. This anticipatory step is important to do to prevent a bad credit score in the future. Moreover, it is suggested to choose a short tenor to minimize the interest. This is because the longer the tenor, the higher the interest expense charged.

Those are some tips for choosing an online loan that you can apply. Even though it seems practical, it doesn’t mean that online loans are risk-free. Make sure that the installments you submit are in accordance with your income. If you cannot pay, you will get several problems, such as the loan institution will bill your family to the point where even their debt collector must contact your friends or relatives. You surely don’t want your credit info to be known by other people, right? Remember, choose a trusted financial institution so that your data won’t be leaked by irresponsible parties.

For those of you who have a business, an online credit service without a card is one payment option you can add.

With the increasing number of internet users, this option can be an advantage to your business to facilitate customer payments. Online credit payment methods can be activated using Duitku Payment Gateway, as it has been used by Indodana. By using Duitku, Indodana is a trusted institution that offers loan tenors up to 3-6 months and is ready to provide loans up to IDR 8 million.

Be a smart customer and know the advantages and disadvantages you get before applying for an online credit service without a card!