How to Create a Professional-Looking Company Website

The high number of internet users in Indonesia makes business owners compete to make use the internet as best as they can. Various ways have been done, starting from creating branding on social media with interesting content to making an easily accessible website so the product will become well-known by many people.

However, not all business owners are willing to spend time managing a website. The complicated process which can only be done by people with special skills makes them less interested in website than other social media. When the fact is 62% of customers tend to visit a website to find information about brands and products (Data quoted from the Global Web Index).

So, it is a good idea to start creating a website as a branding/business promotion medium. Display a comprehensive company profile, such as business info to the latest product info so your business will look more credible. Check out the bellow tips on how to create a professional-looking company website.

1. Web Design and Quality Content

Want a professional looking website? Create a website with a minimalist and responsive display when loading pages. It is suggested not to use a design that does not automatically change the screen size into a mobile version because this will interfere with the web layout and make it difficult for visitors to read the content on the website.

Besides considering the design, you also need to consider the content that will be displayed on your website. The content can be in the form of text, images, and videos that bring insights for visitors and catch their attention to the products you offer.

2. Detailed Information about Your Company

When developing a website, make sure you include the correct address and contact information of your company. This can make it easier for visitors to verify the information listed on the website.

In addition, make your website look professional by adding a “contact us” section, which consists of social media links, photos of the business team, along with a brief company profile. Adding a live chat feature is also a good idea so visitors can contact you anytime when they need assistance.

3. Customer Testimonials

A presentation of good testimonials can make you gain the trust of potential buyers. This is because buyers can measure how good the quality of your service or products based on the previous customers testimonials.

Therefore, you need to add a special column to display various customers’ testimonials so that your website looks more trusted.

4. Using SSL Certificate

One of the determining indicators that create the credibility of a website is an SSL certificate. This certificate is indispensable for businesses that use online transaction processing because it is able to protect data traffic between the website server and the customer’s browser from hacker threats.

SSL guarantees the security of buyer data, from credit card information, usernames, account’s passwords and other important data. With an SSL certificate, your website will be safe and secure.

5. A Clear Page Navigation

A clear page navigation is a must. Therefore, it is recommended that you use JAVAScript or HTML code in the menu section to make it easier for visitors to find the information they need.

Also, display the menu and the sub-menu options on your website to make it easier for visitors to access features and content on your website. A clear information structure on the website can be an extra point to increase your business credibility.

In running a business, professionalism is an important thing that deserves our attention. An unconvincing look of a business can make buyers hesitate to do a transaction. Therefore, you can try applying tips of how to create a professional-looking website we have discussed before so your business will look more convincing.

By owning a professional-looking website, the level of credibility and trust of customers will increase because they can see that you are committed in your business. Moreover, a good website can also increase customers’ satisfaction because they can find out in detail about the business/product information you offer. If credibility on this website continues to be maintained and improved, it is possible that your business will grow gradually even during this current pandemic.

If you want to create a website to promote and offer products directly to customers, make it easier for your website or app to accept payments directly on the website by integrating a payment gateway. Payment gateway allows customers to complete transactions so the chance of them canceling a purchase can be minimized.

Payment gateway can make your business checkout transaction process faster and smoother so customers will feel secure when making payments and can do it easily. Also, make sure the payment gateway you choose is officially licensed by Bank Indonesia and equipped with international security standards like Duitku.

Whatever the transaction is, Duitku is the answer!

8 Checklists to Prepare before Starting a Business

Becoming an entrepreneur is a dream for some people. The dream of being free from financial problems and having a large-turned business is often the main reason for people to start their own business.

Unfortunately, for new entrepreneurs, starting a business seems very scary. The fear of the risk of failure to not knowing where to start is something often faced by some people. For that, Duitku has listed 8 checklists that need to be prepared before starting a business.

1. Do a Market Research

Before starting a business, you need to think about a type of business that has a great opportunity to grow. Therefore, you need to do market research by collecting information from the side of potential buyers. Topics of questions, such as why customers buy products, price benchmarks, and quality offered can make it easier for you to find a competitive advantage for your business.

2. Save Money to Start Your Business

Before launching a product to the market, you need money to fund your business. There are three sources that are commonly used by entrepreneurs who are just beginning. First, funds from personal savings, loans from family or colleagues, and investors. Before deciding to borrow money for business funds, make sure that your business has a strong strategy so that investors are interested to invest in your business.

3. Decide a Name for Your Business

A name plays a role in introducing your business to potential buyers. Psychologically, the name has power and can be a reminder and differentiator between your business and your competitors. For that, create a business name that has a strong background story. It’s fine if your business name is short as long as a buyer can remember your business name, even when they only hear it once.

4. Find a Unique Selling Point (USP)

You need to find the unique selling point (USP) of your business because it’s what makes your business different from other competitors. To find a USP, try to summarize your business in two sentences. Next, inform investors or customers about the sentence that comes to your mind.

5. Decide What Product You Want to Sell

After deciding the name and the target market, it’s time for you to start thinking about the products to be offered. Make a framework regarding what products customers want, how to sell them, what things are needed to sell them, and map out the manufacturing process. This will make it easier for you to determine which products to sell on the market.

6. Create a Marketing Strategy

Regardless of how good the product you are selling, you still need to plan the right marketing strategy in order to catch the attention of potential buyers. This marketing strategy includes competitor analysis, long-term targets, strategies and solutions that need to be carried out, sales systems, and a website (if needed). Make a clear plan so that your business can grow quickly.

7. Get a Business License

Although there are no particular rules regarding online business, it is better if you also pay attention to the legal aspect. By getting a business license as early as possible, your business looks much more professional and trusted so customers will feel secure when making transactions in your business.

8. Recruit Employees

For an early business owner, the selection of human resources is often ignored because some people think that a new business is still growing and does not need employees. When the fact is that recruiting employees and planning a clear employee management system is highly recommended so your team formation is in line with your business goals. Therefore, think about the team needed and hire the right employees.

For those of you who are starting a business from scratch, it is very common to do everything alone by yourself or with a limited number of employees. If that is the case, you can take advantage of technology to make it easier for you to manage your business. One of many things you can do to save your time is to use Duitku Payment Gateway to automate your business checkout process.

With Duitku Payment Gateway, you don’t have to bother responding to customer chats one by one to confirm a payment transfer.

Payments from any method can be received automatically 24/7 so shoppers can complete purchases instantly with ease. This easiness in payment will definitely attract buyers to make repeat purchases of your business.

Those are the 8 checklists that need to be prepared before starting a business. Remember, before choosing a payment gateway as your business partner, choose the one who has a license from Bank Indonesia and is PCI-DSS certified like Duitku.

Let’s automate your payment process and start your success with one transaction with Duitku!

What’s the Difference between Payment Gateway and Disbursement?

The technology advancement has changed the shopping methods of many Indonesians. In the past, people tended to shop at physical stores or outlets, nowadays the majority of transactions are done online.

This change in shopping methods also has an impact on the business platforms. The ever-growing numbers of online businesses that provide a variety of products and services makes us compete to attract consumers and develop our business.

One way we can apply to facilitate business transactions is to use advanced payment systems such as payment gateways and disbursement. So, what is payment gateway and disbursement? What’s the difference? Let’s talk about it one by one!

1. What is Payment Gateway?

Payment gateway is a channel that has been connected to an authorized system that allows buyers to make payments directly from your online store. Interestingly, payment gateway allows your business to accept payments from various methods, from credit cards, bank transfers, e-wallet, even payments from the nearest supermarket or post office.

Because the system runs automatically, the digital transaction process becomes easier and faster. The easy payment facilitated by a payment gateway also has an impact on the increasing interest in shopping of the public. If you are good in seeking opportunities, you can use this to develop your business by giving various offers on your product.

The easiness in payment offered by a payment gateway and interesting offers is such a good combo you can apply to your business to attract new potential buyers!

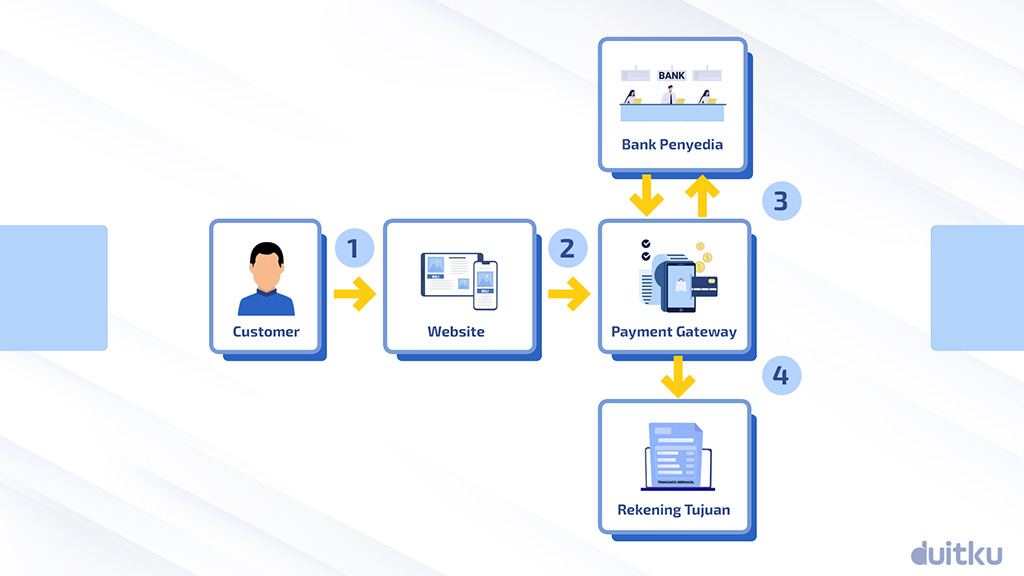

Then how does the payment gateway work?

- The buyer chooses a payment method and pays for the product directly on a website or an online shopping app

- Payment request is forwarded, and the payment is processed by a payment gateway

- Payment gateway forwards information to the destination bank or a payment service provider

- The bank or the payment service provider receives the request and sends a reply to the Payment Gateway system

- Payment gateway sends reply information in the form of “successful” or “failed” transaction status

- The transaction is recorded in the system and the merchant gets a notification of the transaction status. Then the purchase will be processed!

With a payment gateway, you can automate payment receipts on your website or online shopping app. After a payment is received, you will get a notification so that the purchase can be processed and your product can be delivered to your buyer.

2. What is a Disbursement?

Those who have experience in the financial industry must have heard the term ‘disbursement’ quite often. However, do you know what disbursement mean in this context?

In English, the term ‘disbursement’ refers to a payment or expense. Meanwhile, in the banking industry related to financial transactions, the term ‘disbursement’ depends on the context used. For example, Disbursement can be interpreted as a cash payment when a transaction takes place.

Disbursement by Duitku is a payment solution for various business partners in Indonesia. Using the API, transactions can be carried out in real time, accurate, fast, and no need for complicated manual input so that payment errors can be avoided.

How does disbursement work?

Disbursement is usually used by a marketplace or peer-to-peer merchants to distribute funds automatically. Here’s how money transfers work in a disbursement service:

- A user requests a withdrawal or transfer of funds directly on a website or an app

- If the website or the app receives the user request, the request for transfer of funds from the website or the app is forwarded to a payment gateway.

- The payment gateway forwards the information to the destination bank or a payment service provider to determine the authorization to send funds. Here, the payment gateway also performs a second check to ensure the recipient’s name and account number match to avoid wrong transfers

- If the authorization process is successful, the funds are distributed to the destination account in real-time

Then what is an example of the use of disbursement?

Disbursement is usually used by merchant marketplaces or peer-to-peer to channel funds automatically. The service are used for:

Processing Refunds or Payments to Third Parties

For instance, an e-commerce wants to channel funds to sellers, compared to manual transfer which takes a long time, e-commerce utilizes a system that automatically sends the balance according to the price of the product to the seller after the transaction is complete.

What’s interesting about disbursement is it can also be applied to a refund system in e-commerce. If the buyer wants a refund, the seller just has to agree to the refund request and the money will be sent automatically with the disbursement feature. This thing also applies to other financial instrument for buying and selling apps.

Withdrawing Funds from Website or Apps

Suppose you need funds worth 5 million and you decide to make a loan on a lending platform. After the loan requirements are met, the money will be automatically disbursed to your account through a system that has been integrated with the API. So, online loan platform owners don’t need to transfers the money manually! Just imagine, if an administrator has to verify and send the money manually one by one, it might take months for it to be sent.

With the disbursement service feature, the process will be quick and easy.

Payroll (Salary Payment)

Salary payment is usually done with a bank account. In fact, some companies are still doing salary transfers manually. Of course, this can be very time-consuming and difficult.

Now, companies can use the disbursement feature to manage employee salary payments. They just have to set the nominal in the system, and the salary will be transferred automatically to each employee’s account.

Disbursement is designed so that payment system integration can channel large amounts of funds with large volumes. Because it accommodates various payment needs of all customers, of course the system needs to be monitored according to Bank Indonesia regulations. This makes the feature only applies to legal entities or companies.

So that is the difference between payment gateway and disbursement. As a payment solution provider which offers a competitive price, Duitku provides two services to help online businesses in Indonesia, namely payment gateway and disbursement. If you want to receive payments from any method, you can use the payment gateway service.

However, if you want to send money to several people at once in real-time, you can use the disbursement service. Did you get a better understanding about disbursement and payment gateway now?

With the right payment gateway and disbursement service, payment in business can run automatically so you can focus on expanding your business growth. Let’s automate the payment process and start your success with one transaction with Duitku!

Website vs Marketplace, and Their Advantages and Disadvantages

The industrial era 4.0 offers various facilities for the community. The rapid development of digital technology triggers changes in consumer behavior, especially during the COVID-19 pandemic today.

Since the implementation of the activity restriction policy, people who used to be free to shop at the market now tend to do online transactions. As a result, the fulfillment of household needs is carried out through gadgets and digital platforms which have an impact on a surge in business transaction activity. Of course, this poses challenges and opportunities for business people. Businesses who are accustomed to relying on sales in physical stores need to make adjustments by starting an online business to be able to compete.

When starting an online business, there are two platforms that you can choose from, namely Website vs Marketplace. The website shows professionalism, while the marketplace offers convenience. Both have their own advantages and disadvantages. So, which one is better for your business? See more information in the following article.

The Advantages of a Website Compared to a Marketplace

1. Full Authority

With a website, you have a full control over your online store. You can design the store according to the needs and behavior of your customers, from determining the layout, the dominant colors, to the payment methods.

In addition, having your own website also helps you in building your own brand, not just a product name. A brand is the identity of the product. Create a product with a strong brand so that consumers understand what differentiates your brand and your competitors.

Offer a unique shopping experience and create a strong identity for your target consumers to attract potential buyers to shop at your store. With a strong branding, growing business opportunities will wide open.

2. Access to Consumer Information

On a marketplace, you can’t access the consumer’s shopping habits, but this doesn’t apply to a website. On a website, you can find out information related to the best-selling products to less popular ones. Later, you can use this data to plan the right strategy for the development of your business.

Disadvantages of Website Compared to Marketplace

1. You Must be Active on Doing a Market Research

When you start building a website, you might find difficulty to get original traffic. This is only natural because creating a website takes a long time to gain customer trust and maintain its credibility.

What you need to do is maximizing the branding on your website and optimize it well. Don’t let your website fail to compete with your competitors.

2. It Needs a Quite Large Amount of Funds

In making a website, you need a large enough of funds. Starting from hosting and domain rentals every year, website marketing, to regular website maintenance fee. These costs are needed so that website performance can run optimally which makes customers comfortable when transacting on your online store.

The Advantages of Marketplace Compared to Website

1. It Does Not Need a Lot of Funds for the Beginning

Unlike website, selling on a marketplace does not need a large amount of funds. You can just open an online store to sell your products because buyers can find the products you sell easily.

Meanwhile, when selling on a website, you need to pay to create an online store and carry out promotions so that potential buyers are interested in visiting your website.

Even though you don’t need to spend a lot of money at the beginning, the marketplace provides advertising options so that your business will compete with others. You need to pay a number of promotional fees to the Marketplace so that your product will rise on the search column. This must also be taken into account in your future costs to be able to continue to compete.

2. Easier Management

Are you a business owner who have never used an online buying and selling site? Don’t worry! There are currently many marketplaces that are equipped with user guides which makes them user friendly. The management is also much easier and more practical which makes it easy to use for a business owner who is just getting started.

The Disadvantages of Marketplace Compared to Website

1. Fierce Competition

Presented as a forum for sellers, the marketplace offers convenience to build relationships through communities between sellers and buyers. Unfortunately, this also makes business competition in the marketplace very tight. Starting from price competition, quality, to the services provided. That’s why you need to set a careful strategy so that your store doesn’t go out of business.

2. Hard to Gain Customer’s Trust

Despite the broad market segmentation, one of the biggest challenges when selling on the marketplace is gaining a buyer’s trust. Due to the many online crimes happen on a marketplace, such as fraud, poor product quality, and scamming, buyers are much more careful in making transactions.

On a marketplace, it takes time and effort to convince customers that you are a honest and responsible seller. Always sell the highest quality products and ensure good testimonials from customers.

Marketplace vs Website, Which One is Better?

Now you have a better understanding of the advantages and disadvantages of websites vs marketplaces. Whatever your choice is, it all depends on your business needs.

For those of you who choose to make your own online store, try checking the e-book that you can download for free below for tips on maximizing the performance of your online store so you can increase the credibility of your business and be able to compete with others.

In addition to paying attention to the platform that will be used, you also need to pay special attention to the easiness in payment for customer satisfaction. Integrate your business with a payment gateway that has obtained an official permission from Bank Indonesia and meets international security standards like Duitku.

Remember, whatever the transaction is, Duitku is the answer!

Get to Know the 5 Most Popular Digital Payment Methods for Online Store

As time goes by, online shopping has become a common thing to do. Besides being more practical, online shopping offers a wide selection of products so that customers can find the products they like.

In addition, the various types of digital payment methods also make it easier for customers to make transactions. In just seconds, payment transactions can be made quickly, the seller doesn’t need to meet the buyer to confirm the transaction.

Nowadays, there are many types of digital payments that you can choose to meet your transaction needs. What are they? Let’s get to know the 5 most popular types of digital payment methods for online store in the following article!

1. Credit Card

Credit card is one of the options often offered when you want to make online transactions. The process is fast and carries the concept of ‘pay at the end of the month’, allowing you to buy the items you need without paying in full.

Besides that, credit cards with the logo of Visa, MasterCard, and Amex allow buyers to make cross-border transactions. Just look for the item you want in e-commerce, complete the transaction with a credit card, and wait for the item to arrive in your home.

Another benefit is some credit cards often provide 0% installments. 0% installment is a scheme that allows buyers to pay in installments without having to pay additional fees or without large interest. If their cash flow is maintained, customers will definitely be happy.

2. Bank Transfer

In Indonesia, the payment method via bank transfers on m-banking is the most commonly used one. With only a bank account and smartphone, buyers can make transactions by making a transfer and the balance will go directly to the seller’s account.

Previously, payments via bank transfer required customers to make transactions at ATMs, now everything can be done on the internet anywhere and anytime.

3. E-wallet

With a QR code or push notification system, customers can make transactions with their smartphone. Later, the payment will be automatically confirmed by the system so that customers can experience an easy, fast, and practical shopping experience.

Because the use of e-wallet is still relatively new in Indonesia, there are still many promos launched from this digital wallet service provider to support the socialization of the use of e-wallet in Indonesia. So, don’t miss this opportunity!

4. Credit Payment

Unlike credit cards, credit payments involve merchants who have collaborated with credit payment service providers to make payment transactions. This digital payment method is very practical. Customers only need to register online with an Indonesian ID card to determine the amount of the allowed limit. With registration requirements that are easier and more affordable for all kind of groups of people, installment payments without a credit card are predicted to be increasingly in demand.

5. Direct Debit

Direct debit is an electronic payment method that allows banks to automatically withdraw money from the customer accounts to make payment in a transaction.

By using the Direct Debit feature, customers only need to register the card once. For the next transaction, the customer only needs to enter the one time password (OTP) code they receive.

Well, that’s a variety of online store payment methods you can choose. Since digital payments are in demand, it would be great for your online store to start accepting digital payments from now on because various payment methods will make it easier for your customers to make transactions.

To accept digital payments, you need to integrate your online store with a trusted payment gateway like Duitku. Offering a digital payment method with a trusted security system, Duitku is here to help you integrate a payment system smoothly, safely, and automatically. With Duitku, you don’t have to do your work twice harder when customers make mistakes in a transaction.

Let’s use Duitku payment gateway to simplify your business transactions now!

What is QRIS and What are The Advantages?

In this day and age, you must have often heard about QRIS. The payment method that uses the barcode scan has become very popular lately. QRIS stands for Quick Response Indonesia Standard. Simply put, QRIS is a QR code designed according to Indonesia’s national standards. This National Standard QR code was launched by Bank Indonesia and the Indonesian Payment System Association (ASPI) on August 17, 2019.

In the past, before QRIS was invented, every digital payment app in Indonesia had its own QR code. For instance, if there are 10 digital payment apps that you want to use, then there are 10 types of QR codes. Quite burdensome, isn’t it?

To that end, Bank Indonesia and ASPI issued a policy that led to QRIS. QRIS allows one QR code to be used for various digital payment apps available in Indonesia. Therefore, sellers only need one QR code, which is QRIS (Quick Response Indonesia Standard), to accept digital payments from anywhere.

QRIS is also one of the supports given by Bank Indonesia to encourage MSMEs to develop their online business. QRIS is expected to offer an ease of transaction for MSMEs with a lower cost per transaction than e-wallet. This transaction fee is also determined and approved by Bank Indonesia so that the costs incurred will be the same between one business and another.

QRIS: 0.7% of the nominal amount of purchases / transactions

Gopay: 2% / transaction

OVO, LinkAja, Dana: 1.5% + 0.15% (VAT) / transaction

ShopeePay: 1.5% / transaction (Shopee Pay MDR will change to 2% starting March 2022)

Moreover, do you know the benefits of QRIS for sellers and customers? This article will discuss the advantages of QRIS both for sellers and buyers. Let’s take a good look at it!

For Seller

- Easier Transaction Process

- Preventing the Circulation of Counterfeit Money

- Easier Merchant or Store Registration

QRIS can make a transaction process easier and more efficient. As previously mentioned, you only need to have one QR code to use on various digital payment apps that are licensed in Indonesia.

So, the display of the cashier desk will become more modern and neat because there is no need to display multiple QR codes in a row. Each merchant only needs to display the QR code obtained from QRIS.

QRIS is a digital payment code. Thus, no more cash exchanges take place. This also means the risk of getting counterfeit money is getting smaller, including preventing germs that can be transmitted through direct contact during the current COVID-19 pandemic.

Without QRIS, you don’t need to register as a merchant in various digital payment applications and only need to register once to accept digital payments on any app. Quite practical and time-saving, isn’t it?

It’s the same when you want to open a QRIS payment line on your website or online app. Just register at the payment gateway you choose and activate the QRIS payment line.

For Buyers

- More options for the Payment Methods

- Easier Transactions

Nowadays, people tend to choose to do digital transactions. Both when shopping online or in person. In fact, not a few people have transformed into cashless so that they find it difficult when they have to pay with cash.

With QRIS, customers will benefit more because the payment methods are increasingly variable. You can also use any payment method that is licensed in Indonesia.

Moreover, QRIS can be paid with Jenius, OVO, Shopee Pay, Gopay, Dana, LinkAja, Mandiri online banking app, BCA, CIMB and BNI. That way, customers will have more options in determining the payment method they want to use.

Transactions will be easier because customers do not have to carry a large amount of money, count the amount of money to be paid, and count the amount of change they will get. They also don’t have to bother to provide money for change or worry that the nominal of the payment given is inaccurate.

For online payments, customers can directly scan the QRIS displayed on their screen using an online banking or an e-wallet app they use. It can also be paid by uploading a QRIS that has been screenshot on the app they use.

That’s it about QRIS and its advantages for both sellers and buyers. Let’s use QRIS because the service can simplify the transaction process for both sellers and buyers. Don’t hesitate to start a non-cash transaction and make the best of the digital payment apps available. The following is the more comprehensive information about how to receive QRIS on your website

Choose another payment methodPriceUser guide

Do you want to receive payments via QRIS on your online store but don’t know how to do that? Don’t worry! You only need to integrate your store with a payment gateway that can help you accept payments using the QRIS method. However, make sure the payment gateway you choose is secure and has an official permission from Bank Indonesia like Duitku.

With Duitku, you will enjoy various conveniences for all your business transactions, and don’t worry! Because Duitku has an official permission from Bank Indonesia and meets international security standards. We believe that with Duitku, all your business transactions will be faster, easier, and convenient.

Whatever the transaction is, Duitku is the answer!

Save Time Managing Your Business with Payment Gateway

One of the most time consuming things in running a business is managing business transactions. Starting from providing various payment methods to make it easier for customers, providing the total price for orders to be paid immediately, to checking account mutations. Of course it can be very troublesome, especially if you do it all alone by yourself.

However, you don’t have to worry about it anymore because there is technology that can facilitate all your business transactions, namely a payment gateway. A payment gateway is a channel that allows you to receive money from various sources without having to create multiple accounts.

With a payment gateway, you don’t have to take care of various things related to transaction problems, so you can focus on your product development and promotion of your business. Surely, this will make it easier for you to manage your business.

Then, how come a payment gateway can be the best partner for your business? Let’s find out the answer below!

1. It Helps You to Receive Payments from Various Sources

As a business owner, you surely want to provide convenience for your customers to make payments, right? A complicated check-out process can discourage buyers from completing the purchase process. So, avoid this thing by providing a choice of payment methods that suit their needs.

Payment gateways allow you to receive money from various sources without having to have multiple accounts. So, you don’t have to bother opening accounts at multiple banks. You can accept payments from any method, ranging from bank transfers, virtual accounts, credit cards, e-wallet to minimarkets into 1 dashboard account, which can be withdrawn to your main account. Very sophisticated, isn’t it?

2. It Speeds up Transaction Processes and Processed Goods

Usually, when a customer is interested in a product in your online store, they will definitely ask for the available payment methods and ask for the total price to be paid.

After the transaction process is successful, the buyer will send the transfer receipts and you have to check the mutation in your account to make sure the payment has been done correctly, and it can be really time consuming. Moreover, it can be more annoying when a customer decides not to complete the purchase. What a waste of time!

Payment gateway offers a seamless shopping experience that allows all transaction processes to be done automatically, so there is no need for excessive interaction between sellers and buyers. After a customer pays, the seller will immediately get a notification to process the order, while the customer just has to wait for the order to be processed and shipped soon.

3. There Won’t be Any Inaccuracy in the Transfer Amount

If you use a payment gateway, the order amount will be automatically listed when a customer is about to make a transfer. So, the customer does not need to enter the nominal or the intended account number, so as to reduce the possibility of wrong transfer amount, both nominally and in the destination account. So you don’t have to be afraid of making a mistake. Just wait for the notification and send the order as soon as you can.

4. Make Customers Your Regular Ones Thanks to the Convenience Offered

With the convenience offered, surely customers would love to back to your online store because all the shopping processes are very practical and simple, thus inviting them to shop again in the future.

That way, when there are customers who are interested in the products in your online store, they will definitely make payments right away. You don’t have to bother answering the same questions over and over again and customers only have to pay as they wish.

So, after knowing the points above, you surely realize that payment gateway is very helpful to make your business more practical, right? Therefore, let’s use a payment gateway to facilitate your business transactions. You can focus on growing your business without having to think about transactions since everything will run smoothly and automatically.

However, make sure you choose a secure payment gateway partner like Duitku. Because Duitku has a legality from Bank Indonesia and international standard security certification. We guarantee your transactions are safe with nothing to worry about!

Payment Gateway Helps Make Online Transactions More Secure

Currently, the growth of e-commerce in Southeast Asia is increasing very rapidly. Google estimates its value will exceed US $ 200 billion by 2025. With this significant growth, a new problem will definitely arise, namely online fraud.

In Southeast Asia alone, e-commerce will lose US$260 million from online fraud with Indonesia, Vietnam and Thailand on the top three of countries with the hardest hit. In fact, a report from Google shows that Indonesia has the highest rate of e-commerce fraud compared to any other Southeast Asian country at the rate of 44.1%. Wow, that’s a devastatingly fantastic number, isn’t it?

From that, it can be concluded that the biggest challenges in fraud management in Southeast Asia are the inconsistent implementation of fraud management systems and tools, lack of expertise and lack of efficient data management. Then, how to minimize online fraud? Let’s find out the answer in this article.

How to Minimize Online Fraud?

One simple way that you can do is to integrate your online store with a payment gateway. A payment gateway is a technology to make it easier for your business to accept online payments from a website or app. A payment gateway functions as a channel that connects your holding account to the platform where you make transactions. Not only for accepting payments, using a payment gateway can also make online transactions safer!

What Makes Online Transactions with Payment Gateway More Secure?

1. PCI-DSS Certificate

A payment gateway is a technology to make it easier for your business to accept online payments from a website or an app. A payment gateway functions as a channel that connects your holding account to the platform where you make transactions. Payment gateway also allows you to accept payments by credit card.

Payment gateway offers various conveniences for all transactions, but you also have to pay attention to the security certificate owned by the payment gateway that you use. Make sure your payment gateway has a payment card industry data security standard certificate such as PCI-DSS.

The certificate indicates that a payment gateway can maintain credit card data and personal identity used by customers to make payments. So customers will feel safe and comfortable when making transactions on your website because their data is guaranteed to not leak. You will also definitely avoid the problem of data leakage from your online business.

2. 3 Way Authentication

Three-factor authentication is a very important thing to activate if you provide credit card payments. Three-factor authentication can minimize fraud because it requires users to confirm the user’s claimed identity using a combination of three different factors.

The first factor is the card’s expiration date, while the second factor is the 3 digit number on the back of the credit card (CVV). Since September 2015, Bank Indonesia has required online credit card transactions to use the One Time Password (OTP) media, which is sent via short message to a registered mobile number, to authenticate transactions. That is the third factor. This way, we can be sure that the identity of the registered credit card user won’t be leaked.

3. Fraud Detection System

Transacting through a payment gateway makes you feel more secure and comfortable. For sellers, there is no more falsification of payment receipts since all transfers are checked automatically by the system. And for customers, they will feel more secure to make transactions at your online store.

It is because the payment gateway is connected to a number of trusted banks and is equipped with a fraud detection system that can detect fraud. There will be no more incidents of being contacted by a bank for allegedly committing fraud!

4. Save Customer Data

Payment gateways allow you to store customer data that has made transactions at your online store so that when there is a fraud or other necessary matters, you can view the data contained in the payment history with the payment gateway. So, it minimizes the risk of fraud.

Those are some of the things that make a payment gateway ables to minimize fraud. That way, not only buyers feel safe and comfortable when shopping at your online store, but you also feel more secure and convenient in running your business. Are you interested in integrating your business with a payment gateway?

However, you should be careful in choosing a payment gateway as your business partner. Therefore, choose the right partner to develop your online store like Duitku. With Duitku, you will enjoy various conveniences for all your business transactions. And don’t worry! Duitku has an official license from Bank Indonesia, meets PCI-DSS standards, and equipped with a fraud detection system. With Duitku, all your business transactions will be faster, easier, and more convenient.

Whatever the transaction is, Duitku is the answer!

How to Maximize You Sales on Holiday

On holidays, many business owners make certain promotional strategies to increase their sales. One of them is Black Friday. In the United States, Black Friday is used as a moment for brands to provide special promos and discounts for their customers. Whereas in Indonesia, many business owners have not made the best of holidays to maximize promotional activities that leads to the results that are less optimal. In fact, business owners in Indonesia even tend to close their shops off on holidays when actually moments like this opens many opportunities to grow your business.

Since Eid al-Fitr will be here soon which means a fairly long holiday. Let’s get ready to maximize promotions on your online store! During this time, people usually are increasingly active in social networking and routinely do online shopping. Especially when they get their holiday allowance in hand. It is no doubt that when customers see discounts, they will immediately check out without having to think twice. Surely, you don’t want to waste this golden opportunity, do you? Therefore, let’s discuss one by one various promotional strategies that can boost your sales on holidays.

1. Give a Special Holiday Promo

Giving a discount is the most common way that you can do during holidays. You can give special prices for holidays. Moreover, holiday is identical to the moment where some people wait for the brand to do a discount promo. However, don’t forget to specify the product and the amount of discount you want to offer. You don’t want to have any lose because you are too having fun giving discounts. Here are some discount ideas that you can give during the holidays:

- Discount percentage, e.g. 10% discount, 20% discount.

- Discount on shipping fee. For example, with a min purchase. IDR 100,000 customers will get free shipping.

- Bundling discount. For example, buying a package of 2 products with a lower price than one product alone.

- Flash sale: give special prices for certain products.

- And so forth.

Besides discounts, offering a gift is one way of promotion that can be applied while celebrating holidays. You can give special gifts so that people are interested in buying your product to get the gift. For example, by giving holiday allowance gifts during Eid al-Fitr or offering red packets during Chinese New Year. That way, many people will make purchase at your store because they want to get the gifts.

2. Stay Active on Social Media even on Holidays

Although Eid is associated with spending time with family, relatives, and friends, it does not mean that people stop surfing on social media on this day. In fact, the use of social media tends to increase during this time. So, it will be a very missed opportunity if you are not active on social media or even close your business off during holidays.

You can be active on social media by creating holiday-themed content. You don’t have to do promotions or give discounts, you can increase engagement with your followers with other ways. For example, by inviting followers to interact on Instagram to talk about the holiday they are celebrating. Surely, your business’s social media account engagement will definitely increase and your followers will definitely be tied to your brand.

3. Promotion with an Emotional Approach

Buyers will be easily provoked if there is an emotional approach to the product they are going to buy. This is in accordance with a research result from The Institute of Practitioners in Advertising, which states that forms of advertising promotion with an emotional approach can get twice as much profit as a rational approach.

Examples of emotional approaches that we often encounter during Ramadan and Eid are the amount of advertisements on television that feature family themes that can touch the heart of the audience. You can also create a campaign where some of the profits from the sale will be donated to people or places in need. Besides being able to boost your sales, you also contribute to helping others.

4. Make bundling or packaging of special holiday products

Preparing special holiday products is something you can try because customers will feel the product has a limited offer so they have to buy it immediately. In addition, this product is also suitable for sending as hampers to friends, relatives, and even family. Especially, in times like this which do not allow us to meet in person.

To make a product for the holiday edition, you can prepare your store’s favorite product that is packaged with a new look that matches the theme of the holiday, or you can also introduce a new product special for the holiday. This method is believed can increase exposure to new products and repeat purchases for your business’s favorite products. By making holiday edition products, your sales will definitely be selling well!

For more details on tips to improve the performance of your online store during the promotional season, you can check the e-book which you can download for free here (hyperlink to https://www.niagahoster.co.id/ebook/audit-toko-online)

Those are some things you can do to maximize your business opportunities on holidays. Are you interested in doing it?

In developing a business, of course you need the right partner suitable for your business. However, in choosing a partner, you should be very careful. Therefore, please choose the right partner to develop your online store, like Duitku. With Duitku, you will enjoy various conveniences for all your business transactions. You don’t need to worry, Duitku has an official permission from Bank Indonesia and meets international security standards. We believe that with Duitku, all your business transactions will be faster, easier, and more convenient.

Let’s start your success with one transaction!